Indian markets are set to open cautiously amid weak global cues. FIIs remained net sellers, while DIIs offered support. Most sectors faced pressure, with PSU Banks and Chemicals outperforming on selective buying and stock-specific strength.

Market Outlook:

Indian equity markets are expected to open on a cautious note amid weak global cues. US indices closed sharply lower, led by selling pressure in technology stocks, which dragged Asian markets into negative territory. Gift Nifty trading in the red indicates a soft start for domestic indices, while elevated volatility suggests markets may remain range-bound with a negative bias in the near term.

FII and DII Activity:

Foreign Institutional Investors (FIIs) continued their selling streak, emerging as net sellers, reflecting a risk-off stance amid global uncertainty. In contrast, Domestic Institutional Investors (DIIs) provided partial support to the market with net buying, helping cushion the downside and preventing a sharper correction.

Sector Activity:

Sectorally, pressure was visible across most indices. Metal, IT, Auto, FMCG, Realty, and Private Banks witnessed selling, largely tracking global weakness and commodity volatility. PSU Banks and Chemicals outperformed the broader market, supported by selective buying and stock-specific strength, indicating rotational interest within defensives and value pockets.

Derivatives – Long, Short, Long Unwinding & Short Covering:

Derivatives data indicates fresh long buildup in stocks such as UNOMINDA, NYKAA, and POLICYBZR, suggesting selective bullish bets. Short positions were added in counters like NAUKRI, LTF, and KAYNES. Long unwinding was observed in names such as ALKEM, BAJAJ-AUTO, and VBL, reflecting profit booking, while short covering in FEDERAL BANK and BDL indicates easing bearish positions at lower levels.

Top 5 News:

• Kaynes Technology reported strong Q3 results with robust revenue and EBITDA growth, supported by a healthy order book.

• Bharti Airtel posted a decline in net profit due to one-time charges, though ARPU and India revenue showed strong growth.

• Hindustan Copper delivered sharp profit growth and announced an interim dividend on the back of improved realizations.

• LIC reported steady Q3 earnings growth with strong traction in premium income and product mix improvement.

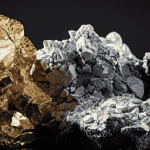

• Silver prices witnessed a sharp crash, driven by a stronger US dollar and hawkish global central bank cues, impacting metal stocks.

Deepinder Goyal Steps Down as Eternal CEO; Albinder Dhindsa to Lead From February 2026

3 min Read Jan 22, 2026

SEBI Changes Closing Price Calculation: Auction-Based Closing to Begin from August 2026; Know How it Will Work

5 min Read Jan 21, 2026

Sensex Down Over 1,000 Points, Nifty at Three-Month Low: What Triggered Sell-off in Indian Market?

4 min Read Jan 21, 2026

Volume Shocker Today, Jan 6, 2026: Aurobindo Pharma Hit Records Highest Single-Day Volume in Almost 2-Months; Here’s Why

2 min Read Jan 6, 2026

Post Market Update Today Jan 05 : Nifty Ends 3-Day Rally, Dragged by HDFC Bank and Infosys, Sensex Ends 322 Points Lower; IT Stocks Fell Nearly 1.5%

2 min Read Jan 5, 2026

Bharti Airtel Share Price Trades 1.5% Higher After Q3 FY26 Results

2 min Read Feb 6, 2026

Hindustan Copper Q3 FY26: 148% increase in YoY Profits, Announces Dividend

2 min Read Feb 6, 2026

RBI Monetary Policy: Repo Rate Held at 5.25%, Neutral Stance Continues

2 min Read Feb 6, 2026

Gold and Silver Prices Crash After Record Highs: Key Reasons Explained

2 min Read Feb 6, 2026

Hitachi Energy India Share Price Today: Upper Circuit After Robust Q3 Results

2 min Read Feb 6, 2026