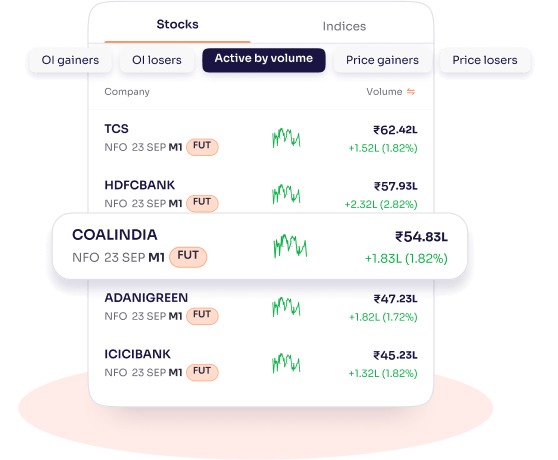

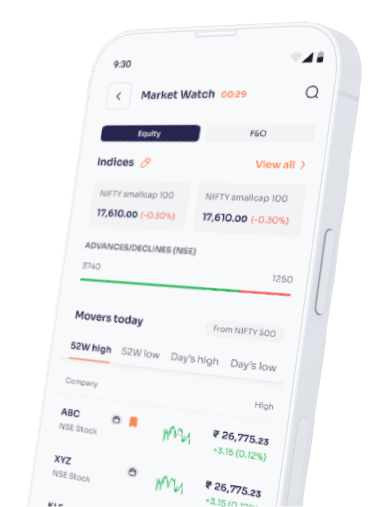

Discover key market movements and insights

for 5000+ stocks across NSE & BSE

Make multiple watchlists to keep track of up to 150 stocks

Stay updated with daily, weekly, monthly gainers/losers & the latest stock news

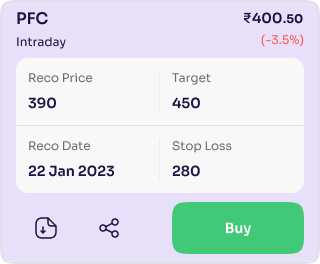

Gain access to research-backed investment calls

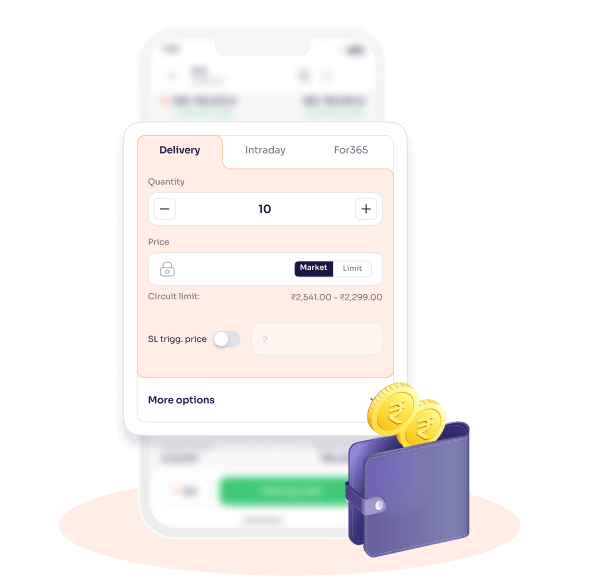

Save your order preference for instant trades

Place trades instantly on call

Own your favourite stocks for 90 days by paying up to 45% with margin trading

Place orders at your desired target price with the ‘For365’ feature (GTT)

Capitalise on key updates of results, dividends, bonuses and splits

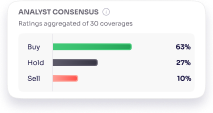

Analyse stock fundamentals, financial ratios & various other filters to identify future multibaggers

Best in class brokerage and multiple plans to choose from.

Completely commission-free

stock trading.

Only fixed brokerage charge,

no hidden charge.

Start your investment journey

online in just 3 steps

Create your account

Open your account instantly with your Aadhaar & PAN

Add money

Add money to your wallet in a few clicks via UPI or IMPS/NEFT/RTGS

Start Investing

Invest in Stocks and Mutual Funds or start trading in Futures & Options in minutes

Equity Stock or Shares are units of a company that can be invested in by individuals or organisations with a Trading & Demat Account. Any company listed on stock exchanges such as BSE, NSE, etc. can be invested in by prospective investors. Investing your funds into a particular stock grants you ownership up to the purchased value. i.e. assuming a company has 100 shares and you invest in 1 share, you have ownership of 1% of the company.

Investing in shares is generally aimed at increasing your money’s worth. Due to market factors & the company’s performance. The price of a company’s shares may rise or fall. Investors aim to purchase such shares whenever the prices drop and hold them for the long-term, estimating that the value of their investment will grow in tandem with the company’s growth. Traders on the other hand aim to target daily/short-term fluctuations in stock prices and profit by buying low and selling high.

This ownership can grant you the chance of earning further funds via two major methods, viz. Dividends & Sale proceeds.

Owning a share entitles you to earning a dividend as and when one is declared by the company. For instance, if you own 20 shares of a company and the company announces a dividend of Rs. 10 per share, then you will get a total dividend of Rs. 200.

Sale Proceeds refer to the amount earned by you after selling the shares owned. Depending upon the company’s performance or the overall market’s ebbs & flows the market price of a stock is liable to change. Traders and market experts aim to tap into this opportunity and purchase stocks at a lower price and sell them when the price rises.

We’re currently building brand new account opening process to help you open your digital trading and demat account within 10 minutes. Drop your details here to be notified as soon as we’re up and running.

Picking the right stocks to invest in may be confusing or even difficult for some. Here are a few steps which can help you:

Being a market linked investment instrument, stocks are subject to risks such as market volatility and a decrease in value. However sound financial practices such as investing in bluechips, analysing stock/market fundamentals can help you securely build your stock portfolio. As a thumb rule it is wise to consult your financial advisor before investing.

Stock transactions generally involve two different types of tax, Capital Gains Tax and Securities Transaction Tax.

Capital Gains Tax is levied if and when you sell stocks at a profit. (Gain further capital on your investment) Depending on the time for which you hold on to these stocks, this tax can be Short-Term Capital Gains (STCG) Tax or Long-Term Capital Gains (LTCG) Tax. Profits made by selling off stocks within 1 year incur STCG Tax which is charged at 15% of the profit, while the profit on selling stocks after a year’s holding are termed as LTCG and are levied at 10% on any profit exceeding ₹1 lac.

Securities Transaction Tax is applicable upon stocks as and when they are traded on the stock exchange. It is levied across both Buy and Sell transactions for delivery trades at 0.1% of the transaction value and only upon the sale of intraday trades at 0.025% of the transaction value.