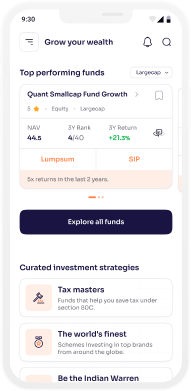

Explore over 1600 schemes across AMCs to build wealth

over the long-term

Choose from mutual fund baskets that suit your needs

Reach out to our support desk to have your doubts and queries resolved

Set your financial goals and leave the rest up to us.

We strive to give you the best in class prices to maximize your earning potential and help grow your portfolio.

Start your investment journey

online in just 3 steps

Create your account

Open your account in minutes with your Aadhaar & PAN

Select scheme

Choose your preferred schemes from Equity, Debt & Hybrid funds

Start Investing

Invest via Lumpsum or SIP to save tax & build wealth over the long-term

A Mutual Fund is an investment instrument organised by an Asset Management Company (AMC) where a number of investors with similar or common investment objectives can pool their money and invest in equities, bonds, money market instruments and/or other securities.

Eg. Investors who want to invest in shares of Large-Cap companies can invest in Large-Cap Equity Mutual Funds. This pool of money is managed by a professional Fund Manager, and specific units corresponding to their investment amount are allocated to each investor.

The main advantage of such an investment option is that it allows individuals to make returns without needing to constantly monitor their portfolio. Additionally, prospective Mutual Fund investors may choose to invest their chosen amount at fixed periods via SIPs (Systematic Investment Plans) or at once as a Lumpsum.

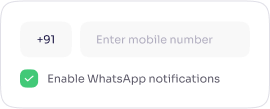

Interested in investing in Mutual Funds? We’re developing an omni-channel investment interface offering with 2500+ Mutual Fund schemes, Fund performance rankings and more! Here’s where you can sign up for early access.

Mutual Funds in India may be divided into many sub-categories based on their structure, invested assets etc. Their main categorisation may be basis:

Investment Patterns

Mutual Fund Asset Classes

Investment Goals

When selecting a Mutual Fund scheme an aspect often overlooked by beginners is to match your schemes to your investment goals. Instead of merely selecting the scheme that displays the highest return figure you should consider:

Your investment objective: Do you plan to grow your money to meet a certain life-goal, build a retirement corpus or are you using it to mainly get secure/market linked returns? The best mutual funds to invest in will depend on such insights.

Invested Assets: Mutual Fund schemes invest in asset classes such as equity, debt or a combination of them, each of these assets will behave differently; For example Debt funds may grant you stable returns, while ELSS will grant you the option to claim tax deductions.

Performance: While all mutual fund schemes will reflect their returns up-front, be sure to check their historical performance. It will also be helpful to compare the Mutual Fund house’s track record across schemes as well as the fund manager’s experience. Lastly, map the returns of the scheme against its benchmarked index/category to help gauge whether the returns are truly due to better fund management by the Fund house or a sectoral upswing.

Yes, certain Mutual Fund Schemes such as Equity Linked Savings Scheme (ELSS) help you reduce your taxable income by 1.5 lac under Section 80C of the Income Tax Act if you have opted for the Old Tax Regime. Furthermore at Ventura we offer you curated baskets that enable you to align your investment to your goals.

We’re just adding the finishing touches to our brand new investment platform, do check back soon to avail exclusive offerings across 2500+ schemes. Register here for early access and get an exclusive pricing offer.

SIP and Lumpsum investment are two ways to go about investing in Mutual Funds:

SIPs (Systematic Investment Plans) are a feature of Mutual Funds that lets investors schedule their investment in specific amounts and predefined intervals.

For Eg. If an investor wants to invest an amount of ₹60,000 with an AMC scheme over a year; They may wait to amass the required amount or start investing with an SIP of ₹5,000 every month. Investors who tend to have a regular cash flow may consider SIPs as an apt investment avenue.

Lumpsum refers to a method of investing in Mutual Funds where the investor deposits the amount they intend to invest at one go. Unlike SIPs there is no scheduling for monthly/periodic deposits and the minimum investment amounts for Lumpsum deposits also tend to be higher than those for SIPs. Investors with higher funds at their disposal but at irregular intervals, may consider investing in Lumpsum.

Net Asset Value or NAV is the worth of each individual unit in a Mutual Fund. Unlike stocks which have a specific market value and can be purchased at their market price, Mutual funds issue units to investors against their invested amount and their value is decided basis the value of the total assets under the fund’s management.

Eg. If a Mutual Fund has assets worth ₹50 Cr. and has issued 1 Cr. units across investors, its NAV will be ₹50.

The NAV for every Mutual Fund is revised at the end of every trading day and updated on the next trading day. Generally schemes with a consistently high NAV can be considered as good investment avenues.

There are no charges for investing in Mutual Funds with Ventura. You will be able to browse through our Mutual Fund offerings and invest in your preferred schemes. The only charges applicable would be on the redemption of Non-liquid mutual funds (which are ₹50 per transaction irrespective of your fund value) and any exit load applicable from the AMC/Fund House may be charged from scheme to scheme.