Expectations for a December rate cut by the Federal Reserve have faded, following cautious remarks from officials. Meanwhile, Japan faces growing fiscal concerns, with a large stimulus package and rising debt weakening the yen and heightening economic uncertainty.

The Dollar Index broke decisively above the key 100 level on 19 November and has held that breakout, a move that stood out given how firm a psychological barrier 100 has been throughout the year. The surge reflects a clear shift in macro sentiment, with markets sharply dialling back expectations of a December Fed rate cut as fresh economic data, including stronger September jobs numbers, came in better than feared after the shutdown. At the same time, a sharp slide in the yen driven by mounting fiscal concerns has added further upward pressure on the index, especially since the yen carries the second-highest weight after the euro.

The dollar index is important signal for commodities because the Dollar Index generally tends to move inversely to bullion, base metals and most global commodities.

One of the main reasons behind the Dollar Index’s latest push higher is the sharp pullback in expectations for a December rate cut from the Federal Reserve. The CME FedWatch tool as of 21st November 6 PM. shows a 56.9 percent chance that the Fed holds rates steady next month, a big shift from just a few weeks ago when markets were more than 90 percent convinced that a 25 basis-point cut was coming. That confidence has faded quickly as a run of cautious comments from Fed officials made traders rethink the odds.

Jerome Powell set the tone by saying a December cut is “far from” a done deal. Neel Kashkari added that inflation stuck near 3 percent is still too high for comfort, while Governors Lisa Cook and Beth Hammack suggested it might be too soon for more easing. Others have taken the opposite view. Vice Chair Philip Jefferson has been more worried about the labour market, and Governor Christopher Waller has openly backed another 25 basis-point cut, arguing that conditions are weakening. The conflicting messages have left markets with no clear direction, and that uncertainty has pushed expectations for a December move sharply lower.

The Fed minutes released on 20 November only added to the mixed signals. They showed a rare and fairly deep split inside the committee, with officials cutting rates in October even as some pushed back, warning that easing too quickly could set back the fight against inflation or erode public confidence. The minutes were blunt in saying that participants had “strongly differing views” on what the Fed should do in December, which lines up with the back-and-forth coming from policymakers in recent weeks.

Data issues are complicating things further. The government shutdown may have ended, but the Bureau of Labor Statistics has confirmed that it will not be able to publish the full October jobs report. That means the Fed is heading into a key meeting without a complete picture of the labour market. September payrolls rose by 119,000, better than expected, but came after a rare drop in August. Continuing jobless claims have climbed to around 1.974 million, the highest since 2021, suggesting hiring is slowing. Put together, the uncertainty around the data and the divide inside the Fed have been enough for traders to scale back rate-cut bets, giving the dollar another push higher.

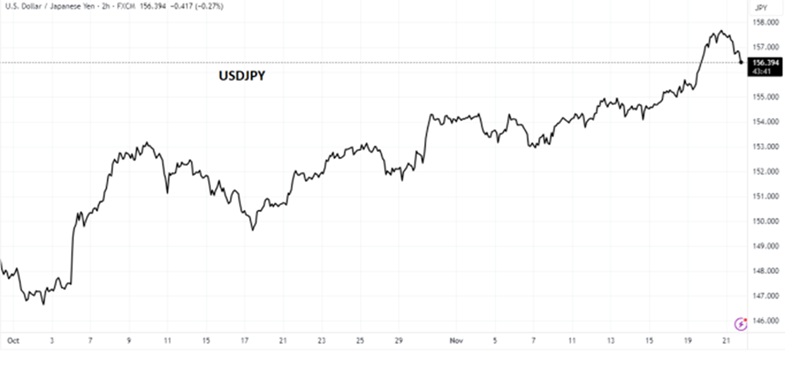

The yen briefly touched 157.89 before easing after Japanese Finance Minister Satsuki Katayama and other officials noted that intervention remained an option if currency moves turned excessively volatile or speculative. The currency has been under steady pressure ever since Prime Minister Sanae Takaichi took office and rattled markets with her expansionist policy stance. Japanese government bonds have also come under heavy selling, with yields climbing to decade highs.

Since the yen carries the second-highest weight in the Dollar Index after the euro, its slide has been a major contributor to the index’s recent strength. Much of the market reaction is tied to expectations around Takaichi’s economic agenda. Japan is preparing a stimulus package of about ¥21.3 trillion to offset the strain of persistent inflation, made up of roughly ¥17.7 trillion in general spending, ¥2.7 trillion in tax cuts, and targeted funding for consumption support, crisis management, and strategic sectors such as AI and semiconductors. A large portion of this plan is likely to be financed through new government bond issuance, deepening concerns about Japan’s stretched public finances. Debt levels stand around 230 to 235 percent of GDP in late 2024 and 2025, the highest among major economies.

Investor sentiment has weakened further after Takaichi scrapped the long-standing budget-balancing target, signalled a shift away from shareholder-focused corporate governance, and ignited a diplomatic dispute with Beijing. Her remarks suggesting Japan could respond militarily if China attacked Taiwan prompted a strong backlash from China, including seafood import restrictions and new travel advisories. These tensions have only amplified fiscal concerns at a time when bond supply is expected to rise. As a result, JGB yields continue to climb, equities remain under pressure, and the yen stays vulnerable. The final size and structure of the stimulus package, which some lawmakers want to expand to around ¥25 trillion, is likely to be the next major catalyst for the currency.

SEBI Life Cycle Funds Explained: Asset Allocation & Long-Term Investment Strategy

4 min Read Feb 27, 2026

Free Lunches Cannot Go on Forever

4 min Read Feb 27, 2026

Should you bond with Bonds - Caveat Emptor

4 min Read Feb 27, 2026

Omnitech Engineering IPO 2026 Opens Feb 25: ₹583 Crore Issue, Price Band ₹216–227, Listing on NSE & BSE

4 min Read Feb 25, 2026

Why FPIs Are Pouring into PSU Banks While Selling Other Indian Sectors in 2026 – Improved Asset Quality, Mergers & Stake Dilution Drive the Rally

4 min Read Feb 23, 2026