Indian IT heavyweights Infosys, TCS, and Wipro fell up to 5% on February 12, 2026, mirroring a sharp sell-off in global technology stocks. The intense pressure dragged the Nifty IT Index nearly 5% lower during the session, making it one of the worst-performing sectoral indices of the day and weighing on the Sensex and Nifty 50.

Stocks such as HCL Technologies, Tech Mahindra, LTIMindtree, Persistent Systems, and Coforge also declined sharply, with all 12 constituents of the Nifty IT index trading in the red in early trade.

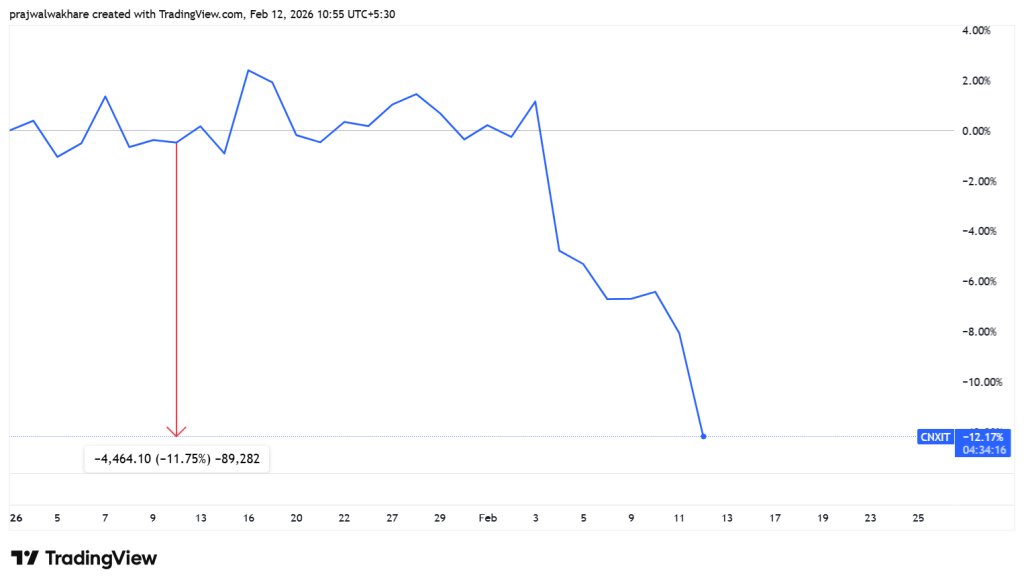

The broader trend has been weak since the start of the year. Data show the Nifty IT index has slid over 12.16% year-to-date (YTD) and more than 10% in the past 30 days as of February 12 (early trade levels).

At the time of reporting, the Nifty IT index was trading 4.48% lower at 33,522.50. Coforge emerged as the top loser, down 5.52%. Infosys, LTIMindtree and Tech Mahindra were down in the range of 4.5% to 5%.

Tata Consultancy Services (TCS) hit its 52-week low of ₹2,776 on the NSE, while HCL Technologies was trading at ₹1,491.70, down 3.86%. Infosys was down 4.43% and TCS 4.23%.

The immediate trigger came from Wall Street. Overnight losses in US technology stocks set a negative tone for Asian markets. Domestic IT companies derive a large share of revenue from the US, so weakness in American tech counters quickly spills over to Dalal Street.

Fresh US jobs data added to the nervousness. A stronger-than-expected January jobs report revived concerns that interest rates could remain higher for longer. Higher rates typically compress valuations of growth stocks, especially technology names that are priced on future earnings.

On Wednesday, Wall Street ended lower. The Dow Jones Industrial Average fell 66.74 points, or 0.13%, to close at 50,121.40, snapping a three-day winning streak. The S&P 500 edged down less than a point to 6,941.47, while the Nasdaq Composite slipped 0.16% to 23,066.47.

The sharp dip in US-listed ADRs (American Depositary Receipts) of top Indian IT companies further reinforced the negative undertone before domestic markets opened.

ADRs allow US investors to buy shares of foreign companies in dollars on American exchanges. When ADRs of companies like Infosys or Wipro fall sharply overnight, it often signals that the corresponding shares could open weak in India the next day. The latest fall in ADRs indicated continued pressure on Indian IT counters.

Beyond macro triggers, artificial intelligence has returned as the central concern. Rapid advances by AI start-ups such as Anthropic and tools like Claude Cowork have intensified debate about how automation could reshape traditional outsourcing and software services.

The concern is that AI tools could increasingly handle coding, maintenance, analytics, legal, sales, marketing and support tasks, putting pricing pressure on the labour-driven model that underpins large parts of the Indian IT industry.

The latest bout of selling also followed fintech firm Altruist’s launch of a tax-planning tool on its AI platform, Hazel, which weighed on financial stocks such as Charles Schwab, Morgan Stanley and Raymond James earlier in the week.

However, industry body Nasscom has dismissed concerns that advanced AI will disrupt India’s technology services sector. It said fears that tools like Anthropic’s Claude Cowork will bypass the Indian IT engine are “misplaced.”

According to Nasscom, Indian technology services companies work closely with global enterprises operating complex, interconnected systems and fragmented data environments. AI is unlikely to be adopted as a simple “out-of-the-box” solution in large enterprises and will require human oversight and deep industry knowledge.

Nasscom identified growth areas including legacy system modernisation, AI-ready data foundations and deployment of intelligent agents across enterprise functions. It said as enterprise AI adoption moves from experimentation to large-scale deployment, technology services firms will play a critical role in enabling the transition and building customised solutions that drive measurable returns.

Valuations have also contributed to the sell-off. After optimism around deal wins and digital demand recovery, IT stocks were trading at relatively elevated multiples. In a risk-off environment, this makes them vulnerable to sharp profit-booking.

Importantly, there has been no major company-specific negative announcement from Infosys, TCS or Wipro. The sell-off appears driven by global tech weakness, US rate concerns, ADR declines and resurfacing AI disruption fears rather than fresh domestic fundamentals.

For now, sentiment remains fragile. Unless US tech stocks stabilise and clarity emerges on interest rates and enterprise spending trends, volatility in Indian IT stocks could persist. The real test will be whether companies can convincingly demonstrate that AI becomes a growth lever rather than a structural threat.

SBI Market Cap Overtakes TCS, Becomes Nifty 50’s Fourth-Largest Company

3 min Read Feb 12, 2026

IT stocks have skyrocketed! Should you pop them off?

5 min Read Jul 22, 2021

Will Indian IT companies continue to outpace expectations?

5 min Read Apr 13, 2021

Are you reading the Q3FY21 report card of IT companies the right way?

5 min Read Jan 14, 2021

Recovery may be underway; but markets might be reflecting it already

4 min Read Oct 17, 2020

6 essentials of a long-term equity portfolio

7 min Read Oct 10, 2020

SBI Market Cap Overtakes TCS, Becomes Nifty 50’s Fourth-Largest Company

3 min Read Feb 12, 2026

Blue Cloud Softech Announces Landmark $1 Billion Investment in India’s AI-Powered Data Center Infrastructure

3 min Read Feb 12, 2026

Stock Market Update Today, Feb 12: Sectoral Shift Underway: Auto, Pharma Lead as IT Weakens Near Key Resistance

3 min Read Feb 12, 2026

BHEL Share Price Slides 6%: Why Is the Stock Falling After ₹4,422 Crore OFS Opens?

3 min Read Feb 11, 2026

Titan Company Q3FY26 Results: Profit Surges 61%, Festive Demand Powers 40% Growth

3 min Read Feb 11, 2026