Venezuela has re-emerged as one of the most consequential geopolitical flashpoints for global commodity markets in early 2026.

In a dramatic escalation, the United States carried out its largest intervention in Latin America in decades on January 3, capturing Venezuelan President Nicolás Maduro and transferring him to New York to face drug trafficking charges. Under President Donald Trump, Washington has simultaneously opted to engage with remnants of the existing power structure in Caracas, seeking to exert leverage over immigration flows while reopening Venezuela’s energy sector to greater participation by U.S. companies.

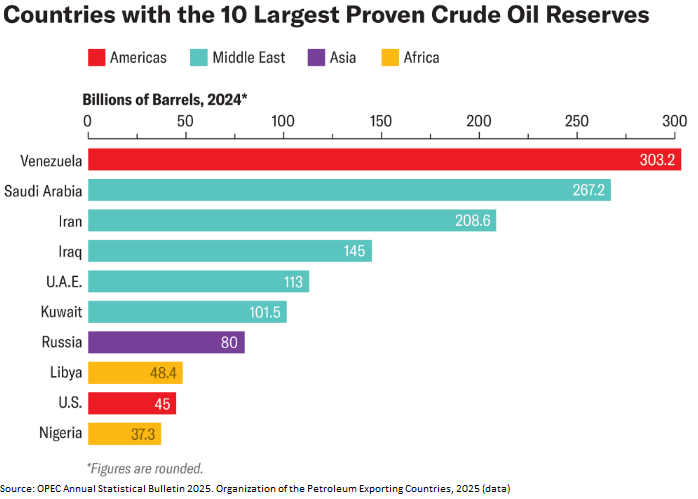

For commodity markets, the longer-term implications could be significant. Venezuela holds the world’s largest proven crude oil reserves and substantial deposits of gold, iron ore, bauxite, and prospective rare earth resources. Much of this resource base has remained underutilized after years of sanctions, operational decline, and chronic underinvestment, leaving considerable latent supply potential.

Why Does Venezuela Matter for Commodities?

Oil: Venezuela’s oil reserves are estimated at around 303 billion barrels, largely consisting of extra-heavy crude in the Orinoco Belt. However, production has collapsed over the past decade. In 2015–16, output averaged 2.3 to 2.6 million barrels per day, but has since fallen to roughly 0.8 to 1.1 million barrels per day, making Venezuela the smallest producer among the world’s ten largest holders of oil reserves.

Recent geopolitical developments have introduced additional uncertainty for oil markets, particularly over the longer term. U.S. authorities have signalled intentions to exert greater control over Venezuelan oil sales and revenues. President Trump announced on social media on Tuesday that Caracas would hand over between 30 and 50 million barrels of oil to Washington, valued at current market prices. The White House has also said it will selectively ease oil-sector sanctions aimed at facilitating trade and incentivizing investment by U.S. energy companies such as Exxon, Conoco, and Valero.

Over the longer term, these measures could support a gradual recovery in Venezuelan oil output. JPMorgan predicts that, with a political transition and renewed capital investment, Venezuela could increase oil production to 1.3–1.4 million barrels per day within two years and potentially reach 2.5 million barrels per day over the next decade. However, any sustained revival will depend on consistent investment, large-scale infrastructure rehabilitation, operational improvements, and a stable, predictable policy environment.

Natural Gas: Venezuela also has large natural gas reserves, estimated at around 5.5 trillion cubic metres, making it the dominant gas holder in South America. However, gas development has lagged oil. Nearly 80 percent of gas output is produced as a by-product of oil production, reflecting weak gas infrastructure and limited standalone gas projects. As a result, Venezuela remains largely on the sidelines of global gas markets.

Gold: Gold is another area of interest. Venezuela holds around 161 tonnes of official gold reserves, the largest in Latin America, which remain an important source of financial backing. Beyond central bank holdings, geological data point to much larger underground resources. Estimates from asset-level studies of 24 identified gold-bearing mines conducted by CSIS suggest close to 75 million ounces of gold in the ground, although development has been slow and highly concentrated. Around 30 percent of these resources are linked to the Siembra Minera project, which remains at an early stage. As a result, Venezuela is still a very small player in global gold production despite its resource potential.

Other Minerals: Beyond oil, gas, and gold, Venezuela holds large deposits of coal, iron ore, bauxite, nickel, diamonds, and rare earth elements. A 2018 minerals catalogue published by the mining ministry estimates coal reserves of around 3 billion tonnes, iron ore resources of nearly 15 billion tonnes, nickel reserves of about 408,000 tonnes, and measured bauxite resources of close to 100 million tonnes.

Actual production, however, remains modest. USGS data show bauxite output at 250,000 tonnes in 2021, iron ore production at 1.41 million tonnes, and gold production at just 480 kg, highlighting the large gap between geological potential and realised output.

What Can Go Wrong?

Political and Governance Risk: Political risks and uncertainty remain elevated. Following the removal of Nicolás Maduro, former vice president Delcy Rodríguez has assumed office. However, questions persist regarding the breadth of her political legitimacy and the durability of the political transition. Venezuela would require billions of dollars in sustained investment for its vast underground resource base to translate into meaningful production gains. Such investment is unlikely to materialise without clear legal assurances, policy continuity, and a prolonged period of political and macroeconomic stability.

Sanctions and Legal Uncertainty: Sanctions remain a major overhang for Venezuela. While the U.S. has signalled the possibility of selectively easing restrictions, any rollback is likely to remain conditional and reversible, limiting visibility for investors. At the same time, Venezuela faces a severe external debt burden estimated at $150–200 billion, encompassing sovereign liabilities, the debts of state oil company PDVSA, and outstanding international arbitration awards. Around $60 billion of sovereign and PDVSA bonds are already in default, underscoring the scale of the financial restructuring challenge and constraining the country’s ability to attract long-term capital.

Infrastructure Degradation: Venezuela’s oil and gas infrastructure has suffered years of neglect, spanning oil fields, refineries, pipelines, ports, power grids, and gas-processing facilities. Restoring capacity will require substantial upfront capital, long lead times, and complex rehabilitation, which is likely to slow any supply recovery. Even with renewed investment, power outages and equipment failures could continue to cap production, limiting the speed and reliability of output gains.

Geopolitical Spillover Risk: Venezuela also risks becoming entangled in broader U.S.–China and U.S.–Russia geopolitical rivalries. Shifts in global alliances or renewed regional instability could reshape trade flows, financing channels, and end buyers for Venezuelan commodities. Any escalation on this front would raise the risk of renewed supply disruptions rather than delivering the stability markets are currently pricing in.

Market Implications

Immediate Term: Geopolitical uncertainty around Venezuela has increased, particularly following U.S. warnings of further action if interim authorities fail to cooperate with Washington’s demands. Any escalation could support safe-haven demand for gold in the near term. However, the immediate and even medium-term impact on oil and industrial metals is likely to be limited, as Venezuela currently plays only a marginal role in global supply chains due to low production levels.

Longer Term: Over time, Venezuela could regain relevance for commodity markets if political stability improves and sustained investment flows into the energy and mining sectors. A gradual recovery in oil output and increased mining activity could position Venezuela as a more meaningful supplier, particularly for heavy crude and select metals. However, this remains a long-dated optionality story, dependent on capital availability, infrastructure rehabilitation, and a stable policy environment.

Conclusion

While Venezuela’s commodity reserves are among the world’s largest, realising this potential hinges on political stability, legal clarity, and sustained investment. Until then, its impact on global markets will remain asymmetric, long-dated, and highly sensitive to geopolitics.

India–EU Trade Pact: Why It’s Called the “Mother of All Deals”

3 min Read Jan 27, 2026

Crude Oil Rises Sharply After Attacks in West Asia: What It Means for India

4 min Read Mar 2, 2026

Iran War Impact on Indian Markets: Sectors to Benefit and Stocks Under Pressure Amid Middle East Escalation

4 min Read Mar 2, 2026

Securities and Exchange Board of India Revises Gold, Silver ETF Valuation Norms from April 1, 2026

4 min Read Feb 27, 2026

Govt Mandates 20% Ethanol-Blended Petrol from April 1, 2026; Key Stocks in Focus

4 min Read Feb 27, 2026

Tejas Networks Share Price Jumps 26% on NEC 5G Massive MIMO Order Win

4 min Read Feb 27, 2026