The Indian rupee fell past the psychologically significant ₹90 per dollar mark yesterday, a fresh all-time low, extending an eight-month slide before recovering slightly today as bargain-hunters stepped in at extreme levels.

The rupee has underperformed the US dollar this year, especially after the US began ramping up tariffs, ultimately placing India among the highest-tariffed nations. Weak foreign capital inflows, including falling foreign direct investment (FDI) and foreign portfolio investment (FPI), have compounded the pressure. As a result, the rupee has emerged as one of Asia’s worst-performing currencies, having lost over 5 percent against the dollar year-to-date, and its drop from roughly ₹85 to ₹90 has occurred in under 12 months, a depreciation pace far faster than its earlier slide from ₹80 to ₹85 over a much longer period.

Timeline of Rupee Depreciation (USD/INR)

| Exchange Rate Move | Time Taken to Fall |

| 40 to 50 | 10 years, 10 months |

| 50 to 60 | 4 years, 7 months |

| 60 to 70 | 5 years, 1 month |

| 70 to 80 | 4 years |

| 80 to 90 | 3 years, 2 months |

India has seen nearly $17 billion in net equity portfolio outflows so far this year, making it one of the worst-hit markets globally. The softness in FPI has coincided with a slowdown in foreign direct investment, with net FDI turning negative for a second straight month in September due to higher outward investments and repatriation, according to the Reserve Bank of India. While gross inflows remained healthy at $6.6 billion in September, large exits from the strong IPO pipeline have resulted in net outflows as private equity and venture capital investors pull back capital.

Current Account Deficit (CAD):

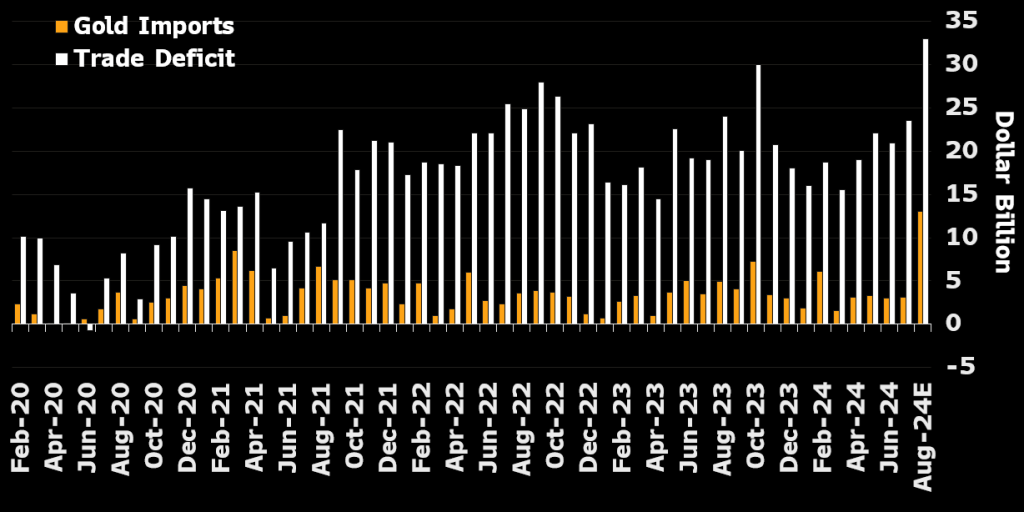

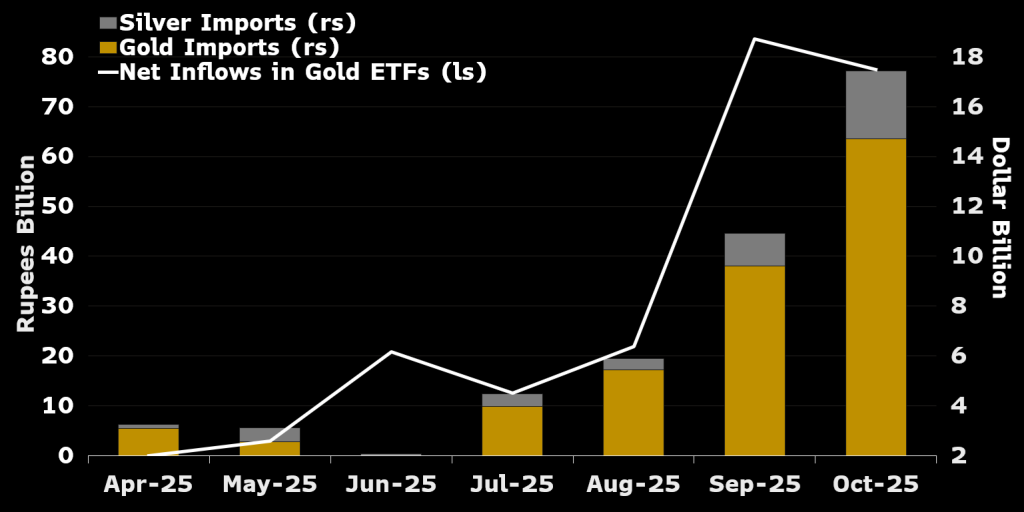

In July to September 2025, India’s current account deficit stood at US $12.3 billion, around 1.3 percent of GDP, with surging gold demand emerging as the biggest drag on the external balance. Gold imports have nearly tripled, hitting a record US $14.72 billion in October 2025 and adding renewed pressure on the trade deficit.

US–India Trade Deal Uncertainty:

Donald Trump’s tariff actions have placed India among the most heavily targeted countries, and efforts to secure a US-India trade deal remain stalled despite expectations of progress before year-end. The continued absence of an agreement has heightened uncertainty over export earnings, slowed trade-related dollar inflows, and pushed up hedging and import-driven dollar demand. Combined with weaker capital flows, these pressures have intensified downward momentum in the rupee even as domestic growth and macro fundamentals remain broadly solid.

RBI Monetary Policy:

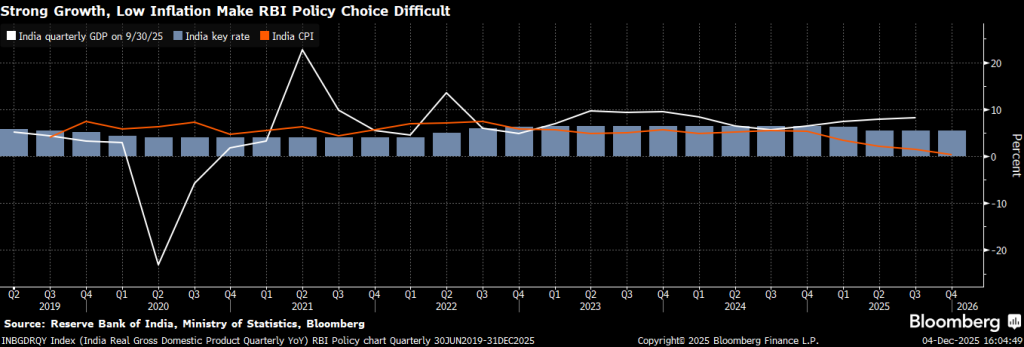

The RBI will announce its monetary policy decision tomorrow, and the steep slide in the rupee makes the call especially challenging. Although inflation is comfortably below target and some economists expect a 25-basis-point rate cut, the currency’s drop below 90, strong economic growth and persistent foreign outflows argue for caution. If RBI Cutes interest rates its generally bearish for Rupee. Traders will closely watch Governor Sanjay Malhotra’s comments on managing rupee volatility and attracting inflows, as expectations increasingly tilt toward a prolonged pause despite earlier indications of room to ease.

Things to Watch Out For:

The rupee has been one of Asia’s worst performers this year, down over 5 percent against the dollar, and its real effective exchange rate at 97.47 in October suggests it is now clearly undervalued. Historically, such undervaluation has drawn foreign investors back within a quarter or two, offering some hope for stabilization ahead.

A quick breakthrough on the stalled US-India trade deal could also support a recovery, while prolonged delays risk pushing the rupee further toward 92. Another factor behind the rapid decline is the RBI’s strategic shift from actively defending the currency with reserves to rebuilding those reserves instead, allowing the rupee to adjust more freely. With dollar supply tight and tariffs still a drag, policymakers appear comfortable letting the currency weaken somewhat to absorb external shocks.

Impact on Commodity Markets: If the RBI cuts interest rates, it would typically weaken the rupee further. A weaker rupee is generally supportive for gold, silver and other commodities priced in dollars, since their value rises in local currency terms. Any additional depreciation could therefore reinforce some bullish momentum in precious metals on MCX, while also increasing import costs for energy and industrial commodities.

Top Gainer Stock: Aditya Birla Sun Life AMC Share Price Zooms Over 6% After Reporting Q3 FY26 Results

3 min Read Jan 23, 2026

ICICI Prudential AMC Resumes Subscriptions in Overseas-Themed Schemes from Jan 27; Sets SIP/STP Investment Limits

3 min Read Jan 22, 2026

Waaree Energies Share Price Hits Upper Circuit; Delivers Record-Breaking Q3 FY26 Performance, Order Book Touches ₹60,000 Crore

3 min Read Jan 22, 2026

Deepinder Goyal Steps Down as Eternal CEO; Albinder Dhindsa to Lead From February 2026

3 min Read Jan 22, 2026

Paytm Share Price Falls Over 5%; Q3 FY26 Results in Focus

3 min Read Jan 21, 2026