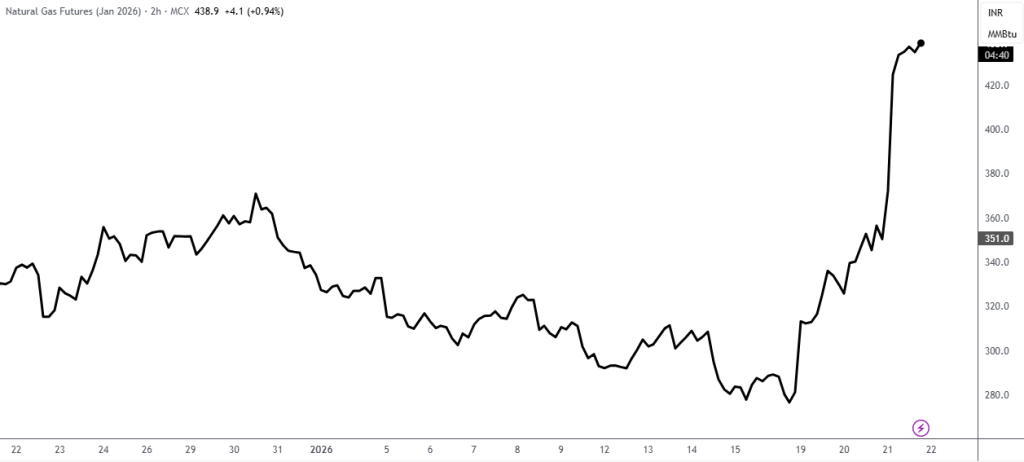

Natural gas prices witnessed a sharp rally this week, surging by over 50 percent in just three trading sessions. MCX Natural Gas, which closed at 280.40 on Friday, rallied sharply to register a high of 455.90 by Wednesday. The sudden spike was driven by an intense Arctic cold blast that descended across large parts of the United States Midwest, Eastern regions, and Europe. The cold wave, which is forecast to persist until the end of the month, has significantly boosted heating demand for natural gas, tightening near-term supply expectations and triggering strong buying interest.

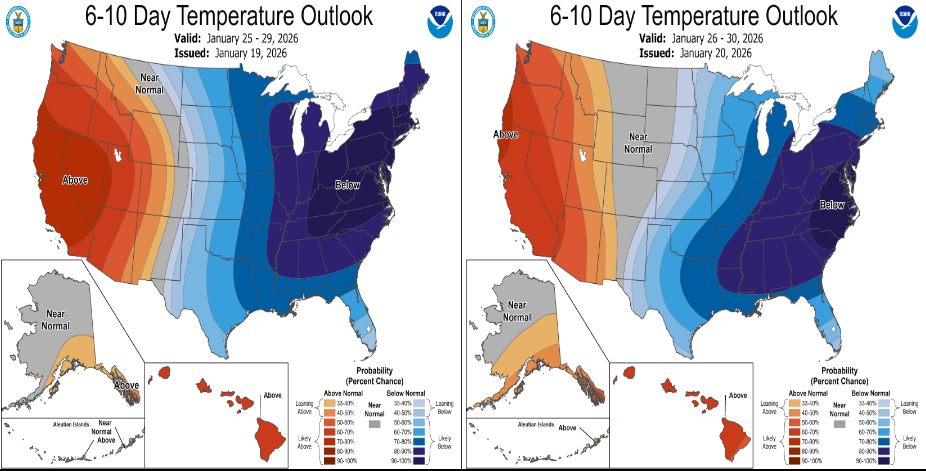

Weather was the immediate driver of the rally. Over the weekend, several weather forecasters warned that colder-than-normal conditions would sharply increase heating demand. On 20 January, the U.S. National Oceanic and Atmospheric Administration cautioned that a major Arctic cold front was spreading across the eastern two-thirds of the United States. According to NOAA, sub-zero temperatures are expected to move from the Northern Plains toward the Southeast and the Gulf Coast. Wind chills could fall below minus 50 degrees Fahrenheit in the Northern Plains and turn sub-zero across the Mid-Atlantic and Southern Plains, raising life-threatening risks of hypothermia and frostbite, potentially worsened by winter storms and power outages.

(Image Source: NOAA, Bloomberg)

One reason the forecast proved to be such a shock was that heating demand had already been strong prior to the release of the colder weather outlook. The sudden shift toward more severe and prolonged cold conditions further heightened market anxiety, triggering panic buying and intensifying the rally.

Such extreme cold can also disrupt natural gas production. Several key production sites are located in Texas, which was also highlighted in NOAA’s forecasts. Freezing temperatures increase the risk of temporary supply disruptions due to freeze-offs, raising concerns over lower output and potential constraints on exports.

Colder weather in Europe also pushed European gas futures higher. Any supply disruptions in the U.S. can have spillover effects on Europe, which has become increasingly reliant on U.S. LNG cargoes after Russia cut most of its gas flows to the continent following its invasion of Ukraine.

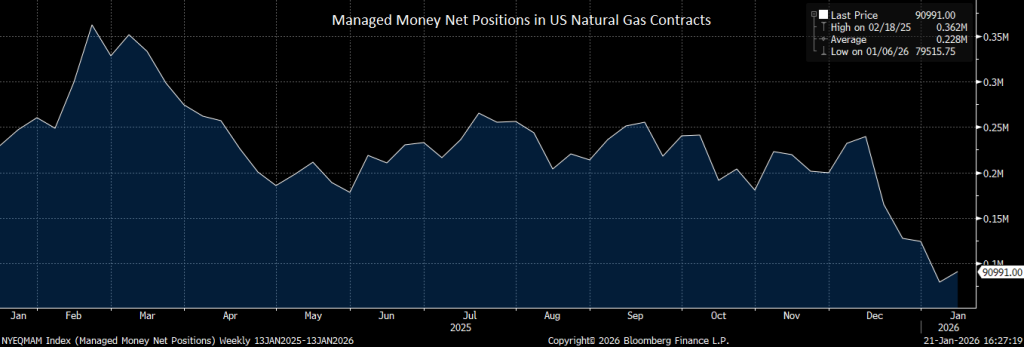

The second driver of the rally was short covering. As the weather outlook turned decisively colder, short positions quickly became untenable, forcing funds that had been positioned bearish on expectations of ample supply and manageable winter demand to cover rapidly. While U.S. inventories are not critically low, they are no longer comfortably cushioned, with weekly withdrawals accelerating and LNG export facilities drawing gas from the domestic market at near-record rates. Strong feedgas demand has reduced market flexibility, particularly at a time when residential and power-sector demand are rising simultaneously.

The chart below shows managed money or hedge fund positions across U.S. natural gas contracts, based on data reported by the CFTC.

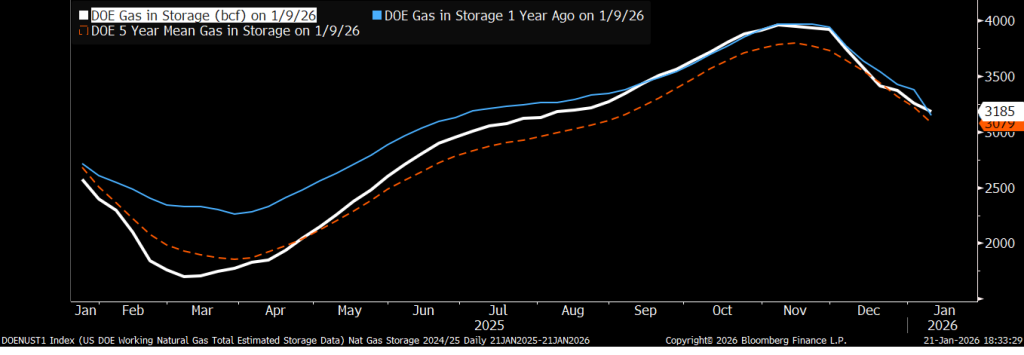

Looking ahead into February, a moderation in weather forecasts toward milder conditions could open the door for a corrective phase. The current term structure already reflects this expectation, with the February contract trading at a discount of nearly ₹100 to the January contract. In addition, DOE storage inventories remain above their five-year average, offering some buffer against demand shocks. That said, natural gas prices are likely to remain volatile and highly sensitive to changes in weather models, storage withdrawal trends, and LNG feedgas demand.

Natural Gas: A Guide to India’s Trading Market

2 min Read Mar 9, 2026

Aegis Logistics: A potential beneficiary of India’s energy transition?

6 min Read Dec 8, 2021

Dazzling future of the Natural Gas Sector in India and happy days ahead for companies in its orbit

7 min Read Nov 19, 2019

Natural Gas: A Guide to India’s Trading Market

3 min Read Mar 9, 2026

Capital Gains Tax on Property in India (FY 2025-26)

3 min Read Mar 9, 2026

Top Coal Stocks in India: Key Coal Mining and Lignite Companies to Know

3 min Read Mar 9, 2026

Long-Term Capital Gains (LTCG) Tax for FY 2025-26

3 min Read Mar 9, 2026

AI Summit 2026 Delhi: A New Blueprint for Global Intelligence

3 min Read Mar 9, 2026