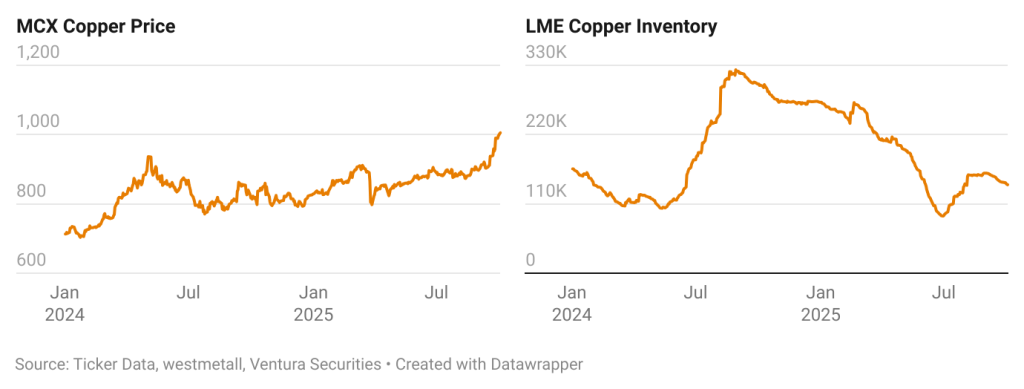

Copper on MCX has been in a firm uptrend since April 2025, supported by a series of supply-side shocks. After hitting a low of ₹795.20 on April 8, copper prices have gained steadily through the summer, with momentum accelerating in recent weeks. Just yesterday, MCX copper price today touched a fresh high of ₹1,026.45, while on the LME, copper prices briefly broke above the symbolic $11,000 mark. The latest rally has been fueled by news of Codelco copper output falling to its lowest level in over two decades following a deadly mine collapse in Chile in July, compounded by Freeport-McMoRan’s earlier declaration of force majeure at its Grasberg mine, the world’s second-largest copper operation.

Copper’s rally this year has been driven more by supply shocks than by demand optimism. Since May, the market has faced a string of disruptions, beginning with flooding at the Kamoa-Kakula mine in the Democratic Republic of Congo, the world’s fourth-largest copper producer, which temporarily halted operations. In July 2025, Chile’s El Teniente mine, the world’s largest underground copper operation run by Codelco, was forced to suspend activity after a fatal seismic event, reportedly linked to geological stresses from extraction processes. Adding to the pressure, fresh data released yesterday by Chile’s state copper agency Cochilco showed Codelco’s output falling to just 93,400 metric tons in August, down 25% year-on-year and marking the lowest monthly production since records began in 2003. In September, Peru’s Constancia mine also faced shutdowns amid escalating protests and political unrest. Most recently, Indonesia’s Grasberg mine, the world’s second-largest copper source, responsible for 3–4% of global supply, was hit by a devastating mudslide that halted production and claimed lives. Operator Freeport-McMoRan has since declared force majeure, warning that full restoration of Grasberg’s operations to pre-incident levels is unlikely before 2027.

Copper inventories on the LME have been steadily declining since August 2024. As of 3rd October 2025, LME stocks fell to 140,745 tonnes, down from a high of over 322,950 tonnes in August 2024. SHFE inventories in China have also fallen, signaling tighter supply and added stress on available copper in the market, pushing copper rate today even higher.

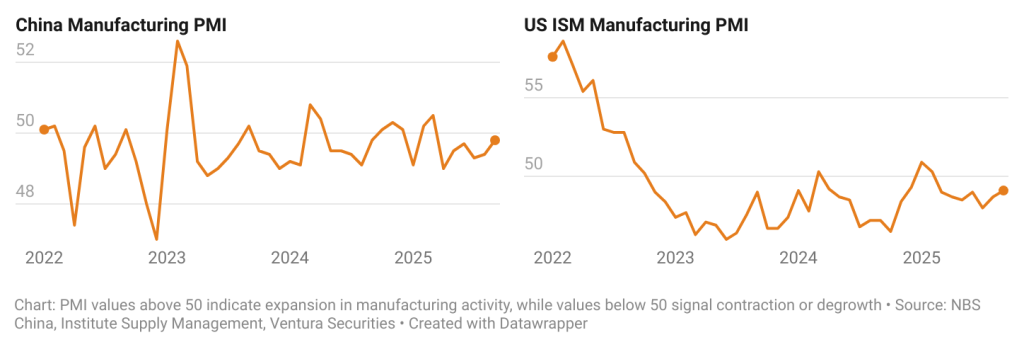

On the demand side, the picture has been far less encouraging, especially from the world’s largest copper buyer, China, which accounts for around 52% of global demand, according to Bloomberg. In August 2025, China’s copper imports fell to a 16-month low, down 11.5% from the previous month to 425,000 tonnes, data from the General Administration of Customs showed. This points to weaker-than-expected industrial activity, a trend also reflected in PMI readings. The Purchasing Managers’ Index (PMI), which measures the health of the manufacturing sector through surveys on orders, production, and employment, has stayed below the 50 mark for most of the period since 2021, signaling contraction. Adding to the weak outlook, wholesale price inflation (WPI) remains in deflation, while other key indicators—GDP growth, industrial production, and retail sales—have consistently underperformed expectations. Together, they highlight the strain on China’s economy and its limited ability to support stronger copper prices.

The International Copper Study Group (ICSG) also warned in April that the market’s bullish, supply-driven narrative may be overlooking a bigger concern: weakening demand. At its latest meeting in Lisbon, the group projected a surplus of nearly 500,000 metric tons across 2025 and 2026, following smaller surpluses in 2023 and 2024. Much of this weakness is expected to come from outside China.

In Europe, Japan, and the United States, copper usage is likely to remain subdued amid high borrowing costs, weak industrial output, and sluggish capital expenditure. Softer construction activity and muted investment in manufacturing are further weighing on copper-intensive applications across advanced economies. The ISM Manufacturing PMI in the U.S. has also shown stress, with most monthly readings pointing to stagnation or contraction. Globally, usage growth has been revised down from 2.7% to 2.4% for 2025, with momentum expected to slow further to 1.8% in 2026.

While long-term structural trends such as electrification, renewable energy, electric vehicles, and data-center expansion continue to support copper demand, near-term consumption outside China is constrained by macroeconomic headwinds. This divergence leaves supply disruptions, rather than demand strength, as the main driver of copper prices in the near term.

The current bullish trend appears driven more by supply-side disruptions than strong demand. While long-term fundamentals remain positive, prices could see short-term corrections as supply tensions ease. On the technical front, Copper price today on MCX faces immediate resistance near ₹1,030; holding above this level could open the way to ₹1,080 and ₹1,150. On the downside, support lies around ₹950, with further levels at ₹900 and ₹870 if prices break lower.

Will AI Change Wealth Management and Mutual Funds in India?

4 min Read Feb 16, 2026

Zero Tax on ₹12 Lakh Income: How Section 87A and Tax Slabs Really Work

4 min Read Feb 11, 2026

India–U.S. Interim Trade Deal Framework 2026: Key Points And Which Sectors Benefit

4 min Read Feb 11, 2026

Aye Finance IPO: What Investors Should Know Before Subscribing

4 min Read Feb 10, 2026

Fractal Analytics IPO 2026: India’s First AI-Focused Public Offering

4 min Read Feb 10, 2026