The relationship between the Securities and Exchange Board of India (SEBI), the capital market regulator, and the Bombay Stock Exchange (BSE), India's oldest stock exchange, has come under scrutiny due to a recent bill presented by the Maharashtra government. If you invest in stocks, you might have noticed a 17% drop in the BSE stock. But what exactly happened between SEBI and BSE? This blog dives into the details of the Rs. 160 crore bill, the potential implications, and the ongoing tussle between SEBI and BSE.

The Maharashtra government introduced a bill proposing a tax waiver of Rs. 160 crore for the BSE. This waiver pertains to stamp duty levied on the exchange's equity capital. The rationale behind the waiver, as stated by the Maharashtra government, is to promote the development of the capital market in the state.

SEBI has raised concerns about the tax waiver, arguing that it grants an unfair advantage to the BSE over other stock exchanges in India. SEBI emphasises the need for a level playing field for all market participants to ensure fair competition and market integrity.

The BSE, established in 1875, contends that the tax waiver recognizes its historical significance and contribution to the Indian capital market. The exchange argues that the waiver will help it invest in infrastructure upgrades and technological advancements to compete more effectively with newer exchanges.

The Rs. 160 crore bill has ignited a debate about the balance between promoting individual institutions and ensuring a fair and competitive market environment. SEBI's role in safeguarding investor interests and maintaining market integrity is crucial. Finding a solution that addresses the concerns of all parties involved – SEBI, the BSE, the Maharashtra government, and ultimately, investors – will be essential for the continued growth and stability of the Indian capital market.

By staying informed about the developments surrounding this issue, investors and market participants can make informed decisions and navigate the evolving landscape of the Indian capital market.

𝐀𝐫𝐞 𝐃𝐅𝐈𝐬 𝐒𝐞𝐞𝐢𝐧𝐠 𝐒𝐨𝐦𝐞𝐭𝐡𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐬𝐧’𝐭?

2 min Read Feb 4, 2026

𝐕𝐞𝐧𝐭𝐮𝐫𝐚 𝐢𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐞𝐬 𝐎𝐩𝐭𝐢𝐨𝐧𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐁𝐮𝐢𝐥𝐝𝐞𝐫

2 min Read Feb 4, 2026

𝗦𝗼𝗺𝗲 𝗛𝗮𝗿𝗱 𝗧𝗿𝘂𝘁𝗵𝘀 𝗔𝗯𝗼𝘂𝘁 𝗔𝗜 & 𝗜𝗻𝗱𝗶𝗮’𝘀 𝗜𝗧 𝗙𝘂𝘁𝘂𝗿𝗲

2 min Read Feb 4, 2026

𝐑𝐨𝐮𝐧𝐝 𝐚𝐧𝐝 𝐀𝐛𝐨𝐮𝐭 𝐭𝐡𝐞 𝐍𝐞𝐰-𝐚𝐠𝐞 𝐈𝐏𝐎𝐬

2 min Read Feb 4, 2026

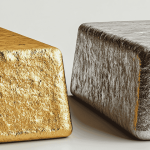

The Silver Sacrifice: What the Gold–Silver Ratio Signals for Investors Now

2 min Read Feb 3, 2026