Online trading has transformed the way people invest in financial markets. In the past, buying and selling stocks required physical visits to brokerage firms or trading floors. Today, everything happens through digital platforms, making the process faster and more accessible. Whether you are looking to invest in stocks, commodities, forex, or cryptocurrencies, online trading offers a seamless experience.

It allows individuals to manage their share market investments, track real-time market trends, and execute trades with just a few clicks. Many people are drawn to online trading due to its convenience, lower costs, and access to global markets. However, before getting started, it is essential to understand the meaning of online trading, how it works, and how to choose the best trading platform in India.

Online trading means buying and selling financial instruments using the internet. Unlike traditional trading, which requires a physical presence at a stock exchange, online trading is done through digital platforms provided by brokers. These platforms allow traders to analyse market trends, execute trades, and manage their investments efficiently.

For example, if you want to invest in company shares, you can do so through an online trading platform without visiting a broker's office. This method is faster, easier, and often more cost-effective compared to traditional trading. With the availability of various trading platforms, investors can now engage in share market investment conveniently.

Online trading follows a simple process. Here is how it works:

Online trading platforms provide real-time data, charting tools, and market insights to help traders make informed decisions. Additionally, automated trading tools and risk management features further enhance the trading experience.

Online trading offers several advantages, making it a preferred choice for many investors. Some key benefits include:

These benefits make online trading a flexible and efficient way to invest in the financial markets.

If you are new to share market investment, starting with online trading can be simple. Here are some steps to help you begin:

By following these steps, you can build confidence and make smart investment choices in online trading. Additionally, setting realistic financial goals and understanding market risks are crucial for long-term success.

While online trading offers numerous advantages, it also comes with certain risks. Some of the most common risks include:

To mitigate these risks, it is essential to choose a secure trading platform, stay informed about market trends, and develop a risk management strategy.

Online trading has changed the way people invest in financial markets. It allows individuals to trade conveniently and access multiple investment opportunities from anywhere. Whether you are a beginner or an experienced trader, understanding the meaning of online trading and selecting the best trading platform in India can help you make informed decisions.

With share market investment, it is essential to research, start small, and continuously learn about market trends. While online trading offers great potential, it also carries risks. Staying updated and using the right strategies can help you maximise your returns while managing risks effectively.

Additionally, understanding different asset classes, diversifying investments, and maintaining a disciplined approach can improve your trading success. If you are looking to enter the world of investments, online trading can be a smart and accessible option for growing your wealth.

𝐀𝐫𝐞 𝐃𝐅𝐈𝐬 𝐒𝐞𝐞𝐢𝐧𝐠 𝐒𝐨𝐦𝐞𝐭𝐡𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐬𝐧’𝐭?

4 min Read Feb 4, 2026

𝐕𝐞𝐧𝐭𝐮𝐫𝐚 𝐢𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐞𝐬 𝐎𝐩𝐭𝐢𝐨𝐧𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐁𝐮𝐢𝐥𝐝𝐞𝐫

4 min Read Feb 4, 2026

𝗦𝗼𝗺𝗲 𝗛𝗮𝗿𝗱 𝗧𝗿𝘂𝘁𝗵𝘀 𝗔𝗯𝗼𝘂𝘁 𝗔𝗜 & 𝗜𝗻𝗱𝗶𝗮’𝘀 𝗜𝗧 𝗙𝘂𝘁𝘂𝗿𝗲

4 min Read Feb 4, 2026

𝐑𝐨𝐮𝐧𝐝 𝐚𝐧𝐝 𝐀𝐛𝐨𝐮𝐭 𝐭𝐡𝐞 𝐍𝐞𝐰-𝐚𝐠𝐞 𝐈𝐏𝐎𝐬

4 min Read Feb 4, 2026

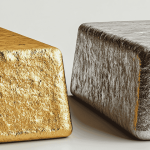

The Silver Sacrifice: What the Gold–Silver Ratio Signals for Investors Now

4 min Read Feb 3, 2026