Making listing gains in IPOs (Initial Public Offerings) is the dream of every primary market investor. Thanks to technological advancements and a well-defined regulatory framework too, IPO investment has become a cakewalk. However, as you may have scour the markets for the best trading platform in India before finalizing on one, so too is it wise to spend some time understanding IPO investment process.

In this step-by-step explainer, we are going to decode the IPO procedure and offer you a crisp commentary on the various facets of the Initial Public Offering process.

The preparatory phase of the Initial Public Offering process is often more time consuming since it involves strategic planning and seamless execution. At times, companies have to undertake major restructuring before going public, which further delays the IPO process.

The selection of intermediaries and advisors plays a pivotal role since they not only affect the decisions pertaining to business valuation but also become the catalyst for the company during this transition.

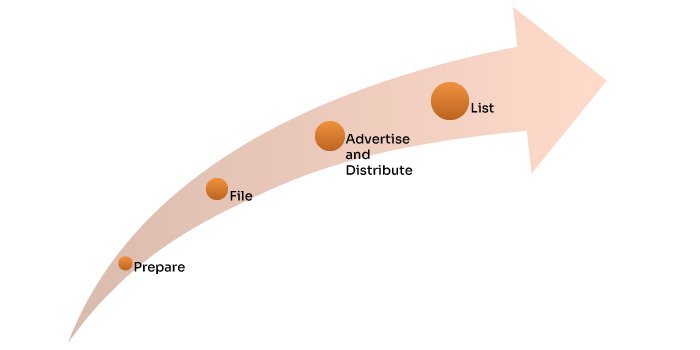

In the four-step IPO procedure demonstrated above, typically, companies spend 6-12 months in the preparatory phase (and sometimes even more time is lapsed). The remaining three stages can be completed in 3-8 months.

The journey of IPO begins with the formation of an IPO committee which is authorised by the board of directors to hire intermediaries, oversee documentation and coordinate with regulatory authorities. Company Secretary (CS), Chief Financial Officer (CFO) and business heads also play a crucial role in the IPO process.

Investment banks act as issue underwriters. Their primary function is to help an IPO-bound company successfully raise money through primary markets. Their role includes but isn’t limited to evaluating the viability of a proposed IPO, assisting the company in documentation and act as the intermediary among various parties involved—the company, investors and regulators.

IPO committee appoints underwriters, depending on their reputation, track record and research capabilities

Company-appointed investment bankers help prepare Draft Red-Herring Prospectus (DRHP) which is filed with SEBI as well as exchanges. Depending on SEBI’s remarks on DRHP, the company makes revisions, if required. DRHP must receive in-principle approval from exchanges and the capital market regulator upon which the company may proceed to file Red Herring Prospectus (RHP) with the Registrar of Companies (RoC).

RHP becomes the master document for all investor education/marketing/persuasion activities. The company can do road shows and interact with potential investors through the media. Underwriters can arrange calls to reach out to anchor investors. After filing RHP with RoC the company can prepare to launch the IPO offer. The issuer is required to announce and advertise the price band at least two days prior to the issue opening.

In theory, there are two methods to price an IPO—fixed pricing and book building. In the former option, the company launches its offer at a fixed price point and anybody interested in applying to the IPO has to bid at the same price. Whereas, in book-building, the company lets the bidders choose the price in the given range as they feel appropriate. The floor and the ceiling prices can be in the range of 20%.

Nowadays, most companies prefer book building option since it is said to facilitate price discovery. The price at which the shares are finally issued to investors is called the cut-off price and any investor bidding below cut-off price doesn’t get shares. Individual investors should always apply for IPO at cut-off price.

Any issue runs for three working days and must have quotas for different sets of investors—institutional, non-institutional, retail etc.

Listing—the final stage in the IPO process

The new listing rules, applicable from 1st December 2023, require companies to list their shares within three days of the closure of public issue (T+3). A shorter time gap between the book closure and listing helps defuse unhealthy speculation about the listing price and enhances the efficiency of the system.

The IPO process can broadly be divided into four phases. The preparatory phase is the most crucial phase that largely decides the fate of any issue. Moreover, the role of underwriters shouldn’t be undermined since they help IPO-bound companies take crucial decisions such as IPO size, positioning and the pricing of issue.

IPOs can provide value-unlocking opportunities to promoters and early investors in private companies, besides offering exciting wealth creation opportunities to IPO investors.

Post your comment

You must be logged in to post a comment.