The world of investing can be intimidating, and filled with jargon and complex structures. One such concept that often confuses new investors is the share class. But fear not! This blog post will be your one-stop guide to understanding share classes, their different types, and how they can impact your investment decisions.

Let us learn the share class meaning. In simple terms, a share class is a category of shares offered by a company or a mutual fund. Each share class comes with its own set of features and benefits, differentiating it from other classes of the same security. These distinctions typically revolve around voting rights, fees, and investment minimums.

There are two main contexts where you'll encounter share classes:

Here's a deeper dive into the most common share classes for companies and mutual funds:

The ideal share class for you depends on your investment goals and preferences. Here are some factors to consider:

Remember: Carefully compare the features and fees of different share classes before making an investment decision. Consulting a financial advisor can be helpful for personalised guidance.

Understanding share classes empowers you to make informed stock investment choices. By considering the unique features of each class, you can select the one that best aligns with your financial goals and risk tolerance. So, the next time you encounter a share class option, you'll be equipped to navigate the investment landscape with confidence.

𝐀𝐫𝐞 𝐃𝐅𝐈𝐬 𝐒𝐞𝐞𝐢𝐧𝐠 𝐒𝐨𝐦𝐞𝐭𝐡𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐬𝐧’𝐭?

2 min Read Feb 4, 2026

𝐕𝐞𝐧𝐭𝐮𝐫𝐚 𝐢𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐞𝐬 𝐎𝐩𝐭𝐢𝐨𝐧𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐁𝐮𝐢𝐥𝐝𝐞𝐫

2 min Read Feb 4, 2026

𝗦𝗼𝗺𝗲 𝗛𝗮𝗿𝗱 𝗧𝗿𝘂𝘁𝗵𝘀 𝗔𝗯𝗼𝘂𝘁 𝗔𝗜 & 𝗜𝗻𝗱𝗶𝗮’𝘀 𝗜𝗧 𝗙𝘂𝘁𝘂𝗿𝗲

2 min Read Feb 4, 2026

𝐑𝐨𝐮𝐧𝐝 𝐚𝐧𝐝 𝐀𝐛𝐨𝐮𝐭 𝐭𝐡𝐞 𝐍𝐞𝐰-𝐚𝐠𝐞 𝐈𝐏𝐎𝐬

2 min Read Feb 4, 2026

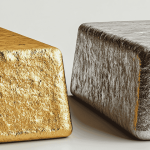

The Silver Sacrifice: What the Gold–Silver Ratio Signals for Investors Now

2 min Read Feb 3, 2026