Global investing has become the new favourite slice of the investment pie — and it is worth exploring what is actually baking inside.

Across the world, every country seems to be hosting its own little crisis — inflation here, growth worries there, policy shifts everywhere. A rate hike in one region, a “boost” in another, and markets move like they are all wired together. From tech rallies to currency dips and geopolitical twists, each global turn reshapes leaders and laggards, year after year.

What does chaos look like? A new surprise every year, delivered by the major global indices — and the table below paints that picture perfectly.

Note: Absolute returns are considered for CY performance, and YTD returns (31 Dec 2024 to 31 Oct 2025) are also calculated on an absolute basis. Source: Investing.com for Kospi*.

Numbers aside, the bigger story is how differently each market behaves — each taking its turn in the spotlight, some rising beautifully, some sinking flat, and a few barely moving at all. The only consistent pattern is that there is no consistent pattern.

And this shifting global landscape is exactly where international funds step in — giving investors a chance to capture opportunities wherever they appear. From just one fund in 2007 to nearly 60 today, the category has quietly levelled up, with an 88% jump in number and a 525% surge in AUM over the last five years.

Though the international fund space may have grown, due to RBI’s overseas limits, AMCs can invest abroad only up to a fixed cap. Once that ceiling is hit, the shutters come down. As a result, only about 21 funds are currently open for subscription.

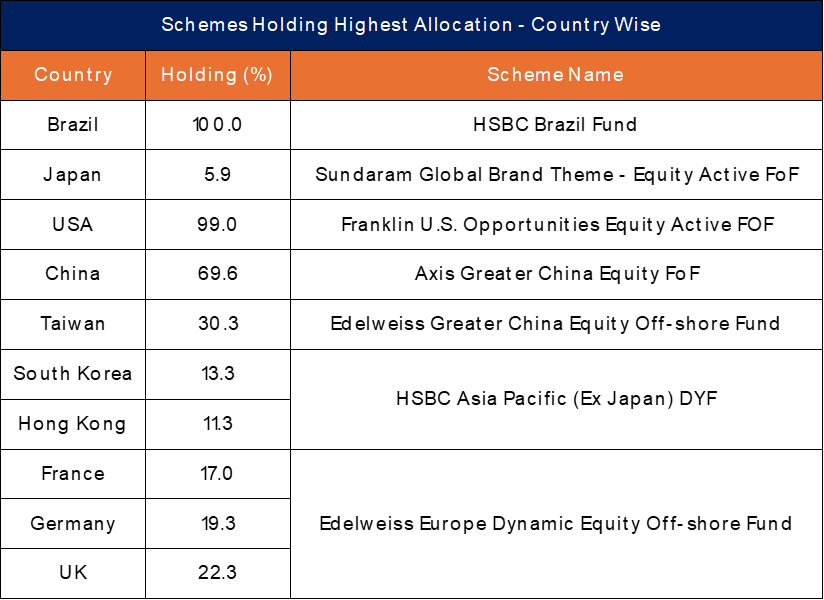

With the investible universe now restricted, evaluating the country-wise exposure of these open funds becomes even more important.

Note: Portfolio Holding is as on 31st Oct 2025.

Check performance of international mutual funds:

International funds may sound like one broad theme, until you see how differently they are positioned. Some lean heavily toward a single country, while others spread out a bit more. The point is not to pick countries — it is simply to understand which markets each fund is naturally aligned with.

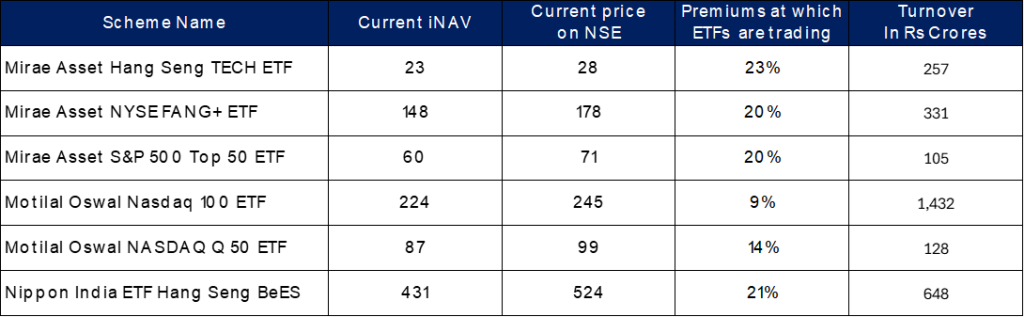

But here is the next twist in global investing — premiums that quietly change the price long before the market does.

With several funds closed for fresh inflows, investors have shifted to the global ETFs still on the shelf. The catch? Many of these ETFs now trade above their fair value (iNAV) — i.e., the underlying assets may be worth ₹80 while the ETF trades at ₹100 — simply because demand is piling up while supply is not. And the moment overseas limits reopen, that inflated price will drift back toward fair value, trimming investor returns in the process — even if global markets perform well.

Note: Purchase date considered is 10th June 2021 for the existing investor and 31st Oct 2025 for the new investor. The current investment date is 31-10-2025 for both.

This real case makes it clear: a premium gap can send two investors in the same ETF to completely different outcomes— one could benefit from timing; the other would have to pay a premium price. And this does not just apply to ETFs; it applies equally to the FoFs that invest in them.

Here is a snapshot of the six global ETFs — and how far their market prices have wandered from reality.

Note: Current iNAV & Current Traded Price on NSE is as on 31st Oct 2025. Turnover (in crores) is for the last 3 months: 1st Aug – 31st Oct 2025.

Given the premium distortion, one sensible approach is to book gains from ETFs trading at unusually high premiums and shift into funds where the gap between the market price and fair value is far smaller. With several global ETFs hovering around 20% premiums, moving into lower-premium FoFs could help ensure a more reasonable entry point. And the frenzy is visible — these six ETFs alone have seen turnover of about ₹2,901 crore in just the last three months.

High Premiums? What should an Investor do now?

A Final Slice of the Global Pie

Going global sounds glamorous, but the fine print ultimately decides the outcome. Markets zigzag, funds open and shut, and premiums quietly drift away from reality — leaving investors to decode what truly matters. At times like this, what separates a good global allocation from a regrettable one isn’t the label on the fund but the discipline to look beneath it. Premiums, liquidity, tracking, and iNAV divergences are not footnotes — they are the investment. In the end, global investing rewards those who look past the brochure, question the obvious, and stay anchored to fair value.

Source: ACE MF, Morning Star, unless otherwise specified.

Budget-to-Budget Winners: Top Performing Defence Stocks from 2025 to 2026

4 min Read Jan 23, 2026

How Top Rare Earth Metal Stocks Performed in FY26: Hindustan Copper, GMDC, MOIL, OMDC

4 min Read Jan 23, 2026

Hot Sectors to Watch Out: Top 3 Performing Sectors From Budget 2025 to Budget 2026

4 min Read Jan 23, 2026

What is Geothermal Energy? India’s First National Geothermal Energy Policy

4 min Read Jan 23, 2026

Gold Price Outlook 2026: $5,000 Rally or $4,600 Pullback Ahead?

4 min Read Jan 22, 2026