The world of online trading is filled with a variety of strategies, some conventional and others bordering on unconventional. Colour trading, also known as colour prediction trading, falls into the latter category. This blog dives into the concept of colour trading, exploring its mechanics, potential risks, and its place within the legitimate trading landscape.

Colour trading presents itself as a seemingly easy way to make money in the financial markets. Here's the basic premise:

Colour trading might appear appealing to new investors due to its:

However, colour trading raises several red flags that investors should be aware of:

Instead of colour trading, consider these legitimate strategies for entering the financial markets:

Read more : What is stoploss market order?

Colour trading presents a deceptive allure of easy money in the financial markets. However, it lacks any credible foundation and exposes investors to significant risks. If you're serious about trading, focus on developing sound investment knowledge and strategies based on fundamental and technical analysis, coupled with effective risk management.

Remember: Always do your research before investing in any financial product or platform. Consider consulting a qualified financial advisor before making any investment decisions.

𝐀𝐫𝐞 𝐃𝐅𝐈𝐬 𝐒𝐞𝐞𝐢𝐧𝐠 𝐒𝐨𝐦𝐞𝐭𝐡𝐢𝐧𝐠 𝐭𝐡𝐞 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐬𝐧’𝐭?

2 min Read Feb 4, 2026

𝐕𝐞𝐧𝐭𝐮𝐫𝐚 𝐢𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐞𝐬 𝐎𝐩𝐭𝐢𝐨𝐧𝐬 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐁𝐮𝐢𝐥𝐝𝐞𝐫

2 min Read Feb 4, 2026

𝗦𝗼𝗺𝗲 𝗛𝗮𝗿𝗱 𝗧𝗿𝘂𝘁𝗵𝘀 𝗔𝗯𝗼𝘂𝘁 𝗔𝗜 & 𝗜𝗻𝗱𝗶𝗮’𝘀 𝗜𝗧 𝗙𝘂𝘁𝘂𝗿𝗲

2 min Read Feb 4, 2026

𝐑𝐨𝐮𝐧𝐝 𝐚𝐧𝐝 𝐀𝐛𝐨𝐮𝐭 𝐭𝐡𝐞 𝐍𝐞𝐰-𝐚𝐠𝐞 𝐈𝐏𝐎𝐬

2 min Read Feb 4, 2026

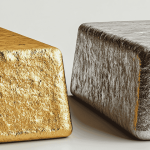

The Silver Sacrifice: What the Gold–Silver Ratio Signals for Investors Now

2 min Read Feb 3, 2026