The Purchasing Managers’ Index (PMI) is a widely used economic indicator that measures the health of the manufacturing and services sectors. It is closely watched by policymakers, investors, and businesses because it provides an early signal of economic trends, often ahead of official GDP or industrial production data.

PMI is a diffusion index derived from monthly surveys of purchasing managers at companies.These managers are well-positioned to observe changes in business conditions such as demand, production, and supply chains.

Scale: 0 to 100 ,

Key threshold: Above 50 → Expansion, Below 50 → Contraction, Exactly 50 → No change from the previous month.

Manufacturing PMI typically aggregates responses across several core areas:

New Orders – Indicates demand conditions

Output / Production – Measures current production levels

Employment – Reflects hiring or layoffs

Suppliers’ Delivery Times – Captures supply chain pressures

Input Prices & Costs – Indicates inflationary pressures

Each component is weighted to produce the headline PMI figure.

China’s manufacturing PMI is especially significant due to the country’s role as a global manufacturing hub. Movements in China’s PMI can signal:

Changes in global trade demand

Shifts in supply chain conditions

Commodity price trends

Broader regional and global economic momentum

China PMI — Official PMI published by China NBS..

According to S&P Global, the Rating Dog China General Manufacturing PMI stood at 50.1 in the final month of 2025.

Interpretation:

The reading is just above the 50.0 threshold, indicating marginal expansion in manufacturing activity.

This suggests that China’s manufacturing sector was largely stable, with only slight growth.

Such a level often reflects cautious optimism, where improvements exist but remain fragile.

Implications:

Manufacturing conditions were neither strongly accelerating nor contracting.

Businesses may be experiencing balanced demand, controlled costs, or gradual normalization after earlier volatility.

Policymakers and investors would likely view this as a sign of stabilization rather than robust recovery.

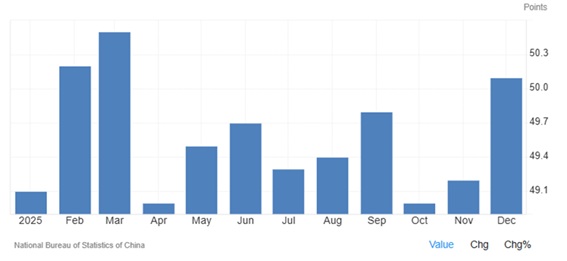

The chart illustrates the movement of the China Manufacturing PMI (right axis) alongside LME copper prices (left axis) over the period from December 2024 to December 2025. A broadly positive relationship is observable between the two series, reflecting copper’s role as a key input in manufacturing activity.

Toward the end of 2025, the PMI rises to approximately 50.1, signaling marginal expansion. This recovery aligns with a sharp increase in copper prices, reinforcing the interpretation that even modest improvements in China’s manufacturing outlook can have a significant impact on industrial commodity markets.

Improvement in China’s Manufacturing PMI can be one of the reasons for the rise in copper prices, as stronger manufacturing sentiment signals higher future demand for industrial metals.

Source: Bloomberg

| Dimension | Official PMI | Private PMI |

| Producer | Government agency | Private research firm |

| Sample Focus | Large & state-owned firms | SMEs & private firms |

| Market Sensitivity | Lower | Higher |

| Release Timing | Month-end / early next month | Earlier (flash & final) |

| Volatility | Lower | Higher |

| Policy Reflection | Strong | Limited |

| Market Use | Policy assessment | Trading & forecasting |

Official PMI provides a structural and policy-oriented view of economic activity, while private PMI offers a market-sensitive and timely perspective, particularly for SMEs. The divergence between the two is not contradictory but complementary, reflecting differences in firm size, ownership, and exposure to market forces.

Good News. Bharat Seems to Be Flourishing…

3 min Read Feb 18, 2026

US Fed Rate Cuts 2026: What Data Signals and Their Impact on Global and Indian Markets

3 min Read Feb 17, 2026

Gold Outlook Remains Bullish; Silver Set for Expansion Phase from March 2026

3 min Read Feb 16, 2026

Will AI Change Wealth Management and Mutual Funds in India?

3 min Read Feb 16, 2026

Zero Tax on ₹12 Lakh Income: How Section 87A and Tax Slabs Really Work

3 min Read Feb 11, 2026