For centuries, gold and silver were not just metals in Indian households —they were the family’s original wealth-keepers. Gold tucked away in lockers or silver coins handed over at weddings, were not just ornaments, they were Plan B for rainy days.

Fast forward to today: market fluctuates, inflation eats into savings, and yet these shiny old friends still remain the go-to safety net. It is not just households that think this way. Even central banks around the world have been piling up gold, pushing their reserves to record highs.

Source: Bloomberg Tavi Costa

After 1996, US Treasuries consistently made up a larger share of reserves than gold. In 2025, for the first time since then, gold’s share has overtaken Treasuries’. Clearly, gold is no longer just emotional — it is economic armour. This global shift sets the tone for investors too, who are rethinking how they hold gold in today’s world.

Ways to Invest in Gold & Silver

Investors today can access gold and silver through multiple routes:

| Options | Overview |

| Jewellery | Primarily for personal use and hence should not be considered as an investment. |

| Coins / Bars | Physical form of investment but comes with storage and purity issues. |

| Sovereign Gold Bonds (SGBs) | Government-backed gold investment; currently,no new issuances are available. |

| Gold and Silver ETFs | Demat-based, liquid, market-traded instruments tracking gold prices. |

| Gold & Silver FoFs | Mutual fund route to invest in Gold and Silver ETFs; SIP-enabled, no demat required. |

| Futures / Commodities | Traded on commodity exchanges but carries higher risk. |

Among these, ETFs and FoFs have emerged as the new-age favourites. No more stacking coins or polishing bars — a click is enough to own gold and silver today.

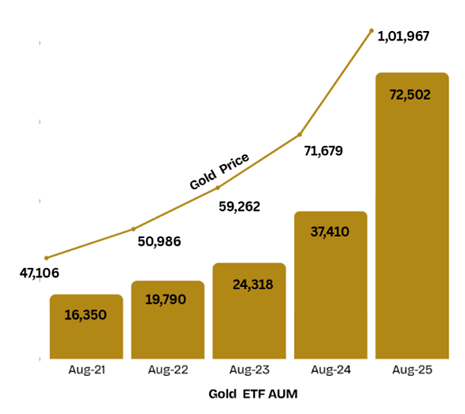

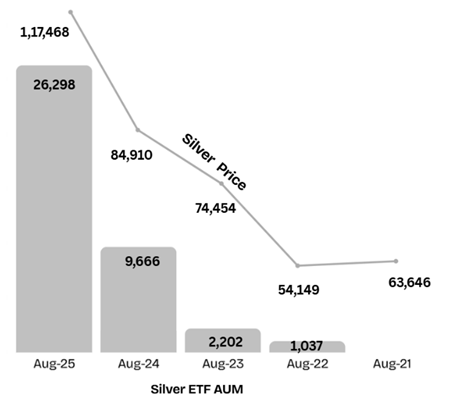

Rising AUM with Rising Prices

As gold and silver prices have marched upward over the last decade, investors have flocked to these modern vehicles. The result? A sharp rise in the AUM of Gold and Silver ETFs and FoFs in India.

Note: Considered Gold and Silver ETF AUM for the past 5 years, along with gold (10gms) and silver(1Kg) prices as of 31st Aug for each of those years.

How ETFs and FoFs stack up against Physical Gold & Silver

Exchange Traded Funds (ETFs): Listed on the stock exchange, directly backed by gold and silver in secure vaults, and trade like stocks. They can be bought in small denominations through a demat account.

Fund of Funds (FoFs): Invest in Gold & Silver ETFs, works well for investors without a demat account. SIP-friendly, but slightly costlier due to layered expenses.

Compared to physical gold and silver, ETFs and FoFs eliminate purity concerns, making charges, and locker fees. Liquidity is far superior — ETFs can be sold instantly, while FoFs can be redeemed at NAV, unlike coins or jewellery where resale involves deductions.

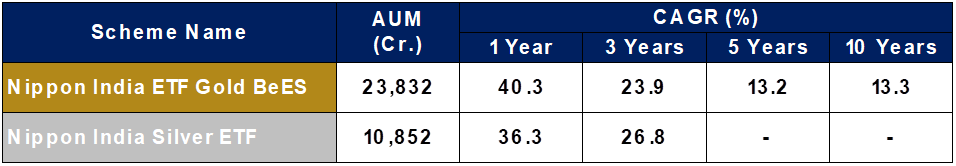

How have Gold & Silver ETFs and FoFs Performed?

The data shows a strong alignment between gold prices, ETFs, and FoFs has remained strong, allowing investors to benefit from gold and silver without the fuss of physical ownership.

Note- Data as on 31st Aug 2025. Considered those ETFs which has highest AUM. Source ACE MF

Gold and silver ETFs have delivered glittering returns, giving portfolios a safety net with a touch of bling — diversification plus a hedge against volatility.

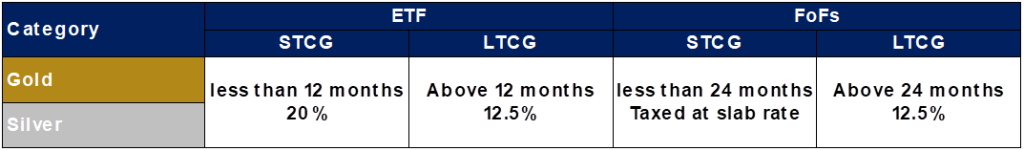

Tax Side of Gold and Silver ETFs & FoFs

Tax rules have recently become simpler and more favourable. This change has improved the post-tax attractiveness of gold and silver ETFs and FoFs compared to earlier.

Exposure to gold and silver can be built through ETFs or FoFs, whichever proves more convenient. And for those who prefer an indirect route, multi-asset allocation funds offer an easy way in, typically holding 5–10% in precious metals.

Also Read: Investing in Silver: all you need to know

The Buoyancy behind Gold & Silver

Central banks are steadily adding gold, investors are finding smarter access through ETFs and FoFs, and taxation has become simpler. Clearly, gold’s relevance has gone beyond lockers and ornaments — it now stands as both a portfolio hedge and a trusted store of value.

At the same time, silver’s importance has surged, fuelled by industrial demand from fast-growing sectors like electric vehicles, solar energy, electronics, and healthcare — while still retaining its traditional role as a safe-haven asset during economic uncertainty.

“Gold and silver have moved from lockers to logins — and the shine has not faded.”

NRI Tax on Gold ETF Gains in India: Updated Rules, Dates & Practical Guidance

4 min Read Jan 16, 2026

Nifty & Bank Nifty Lot Size Changes January 2026: Know How It Impacts Traders

4 min Read Jan 14, 2026

Top 10 Zero-Debt Companies to Watch in 2026

4 min Read Jan 13, 2026

TDS Deduction Rules in India

4 min Read Jan 13, 2026

Settlement Holiday Announced on Jan 15, 2026 — What Investors & Traders Must Know

4 min Read Jan 12, 2026