The stocks of companies that produce essential goods and services are usually called defensive stocks. These are the things people continue to buy whether the economy is booming or struggling. For example, you may cut back on buying a new car during a slowdown, but you will still pay your electricity bill, buy basic food items, or purchase medicines when needed.

Because of this constant demand, the stocks of such companies do not fluctuate too much with market conditions. They give investors a sense of stability, offering steady returns and regular dividends even when the broader market is going through ups and downs. In short, defensive stocks are the “safety net” of the stock market.

You can find defensive stocks in industries where demand never stops.

Things to keep in mind

While defensive stocks are reliable, they also have some limitations. Their growth potential is slower compared to high-growth sectors like technology or banking. This means they may not deliver very high returns in a booming market. That’s why many investors use them as a foundation in their portfolio, along with some growth-oriented stocks for balance.

Defensive stocks represent companies that provide everyday essentials—products and services that people cannot stop using. Their stable nature makes them less sensitive to market fluctuations, giving investors a cushion during volatile times. Adding them to a portfolio brings steadiness, especially when the market mood changes suddenly.

In simple words, they are the part of your investment that helps you sleep peacefully, knowing that not everything depends on the ups and downs of the market.

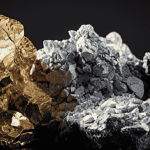

Gold: Tug-of-War Between Safe-Haven Demand and Macro Headwinds

2 min Read Mar 10, 2026

Bullion Demand Surges as Investors Rotate Back to Gold and Silver ETFs Amid Global Uncertainty

2 min Read Mar 10, 2026

NSE to Add Six Stocks to Futures & Options Segment from April 1, 2026

2 min Read Mar 10, 2026

Specialised Investment Funds (SIFs) in Indian AMCs

2 min Read Mar 10, 2026

Natural Gas: A Guide to India’s Trading Market

2 min Read Mar 9, 2026