The Reserve Bank of India (RBI) has kept its key policy repo rate unchanged at 5.25%, in its first monetary policy decision following the Union Budget 2026. The announcement came after a three-day meeting of the Monetary Policy Committee (MPC), which voted unanimously to maintain the status quo. The central bank also retained its neutral stance, signaling a balanced approach to growth and inflation management amid global uncertainties.

Alongside keeping the repo rate steady, the Standing Deposit Facility (SDF) rate remains at 5%, while the Marginal Standing Facility (MSF) rate and the bank rate are maintained at 5.5%. RBI Governor Sanjay Malhotra noted that the current policy rate is considered appropriate given the domestic economic conditions, despite intensifying external headwinds driven by geopolitical tensions and rising trade frictions.

The MPC emphasised that the neutral stance of monetary policy allows flexibility, indicating that rates are likely to remain accommodative to support sustained economic growth while keeping inflation in check.

The RBI revised its near-term growth projections upward, signaling optimism for India’s economic trajectory. Real GDP growth for the current financial year 2025-26 remains unchanged at 7.4%. For FY2026-27, growth in the first quarter (April–June) is projected at 6.9%, up 20 basis points from the previous estimate of 6.7%, while growth in Q2 (July-September) is now seen at 7%, reflecting a modest upward revision.

Governor Malhotra highlighted that India’s economy continues on a “steadily improving trajectory,” supported by strong private consumption, rising fixed investments, and government emphasis on infrastructure development. He noted that high capacity utilization, improved corporate performance, and sustained investment activity will continue to underpin growth, even amid a challenging global environment.

The full-year growth forecast for 2026-27 has been deferred to the RBI’s April policy review, pending the release of a new GDP series.

The RBI also nudged its inflation projections upward for the near term. For FY2025-26, CPI inflation is projected at 2.1%, with Q4 inflation at 3.2%. For FY2026-27, inflation in Q1 is projected at 4% (up from 3.9%) and 4.2% in Q2.

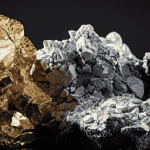

Governor Malhotra attributed the upward revision largely to rising precious metal prices, while noting that underlying inflation pressures remain muted. He cautioned that risks to inflation persist, including geopolitical uncertainty, energy price volatility, adverse weather events, and base effects from the sharp decline in prices in Q4 of 2024-25, which may push year-on-year inflation higher toward the end of the current year.

India’s merchandise exports grew 1.9% year-on-year in Q3 of FY2026, while imports rose 7.9%, resulting in a widening trade deficit. However, the RBI noted that robust services exports and inward remittances are expected to keep the current account deficit (CAD) moderate and sustainable.

Governor Malhotra highlighted that recent trade agreements, including the India–EU free trade pact and a prospective India-US trade deal, along with other agreements, are expected to support exports and deepen India’s integration into global value chains.

Capital flows remained mixed, with foreign portfolio investors recording net outflows of $5.8 billion till February 3, 2026, while foreign direct investment (FDI) inflows continued to be robust. India’s foreign exchange reserves stood at $723.8 billion as of January 30, 2026, providing over 11 months of import cover.

To ensure smooth transmission of monetary policy, the RBI has undertaken durable liquidity-augmenting measures in January and February, following the cumulative 125 basis points cut in the repo rate earlier. The central bank emphasized that it will remain proactive in managing liquidity to support economic activity.

Additionally, Governor Malhotra outlined measures to enhance consumer protection in the financial sector, including a framework to compensate customers up to ₹25,000 for losses in small-value digital transaction frauds, along with draft guidelines addressing loan misselling, recovery practices, and the use of recovery agents.

The RBI’s decision to maintain the repo rate at 5.25% aligns with market expectations, reflecting confidence in India’s strong growth trajectory and moderate inflation outlook. The move is supportive for equities and investment sentiment, especially amid reduced tariff pressures following India’s trade deal with the US.

The continued neutral stance indicates that interest rates are likely to remain accommodative in the near term, providing stability for consumers, businesses, and investors.

RBI MPC Meeting February 2026: Will the Central Bank Cut Rates or Hit Pause?

2 min Read Feb 5, 2026

RBI Changes CIBIL Reporting From April 1, 2026: Full Details and Impact on Borrowers

4 min Read Jan 19, 2026

Do you have any distressed company in your portfolio?

4 min Read Sep 9, 2020

Are markets enjoying their jio ram bharose moment?

6 min Read Aug 28, 2020

Where to invest now when Fixed Deposit rates are falling?

4 min Read Jul 22, 2020

Will Indian banks pass the COVID-stress test?

5 min Read Jul 13, 2020

Bharti Airtel Share Price Trades 1.5% Higher After Q3 FY26 Results

3 min Read Feb 6, 2026

Hindustan Copper Q3 FY26: 148% increase in YoY Profits, Announces Dividend

3 min Read Feb 6, 2026

Gold and Silver Prices Crash After Record Highs: Key Reasons Explained

3 min Read Feb 6, 2026

Hitachi Energy India Share Price Today: Upper Circuit After Robust Q3 Results

3 min Read Feb 6, 2026

Stock Market Update Today, Feb 06: Caution at the Open, Global Markets Slide, FIIs Turn Net Sellers

3 min Read Feb 6, 2026