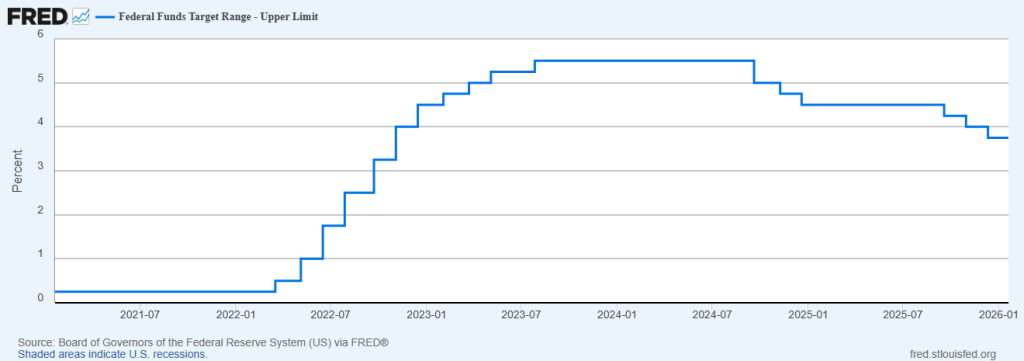

MCX silver crossed ₹3 lakh amid a global supercycle driven by supply deficits, geopolitical risks, Fed rate cuts, weak rupee, and rising industrial demand from AI and solar.

Silver on MCX crossed above the ₹3 lakh mark for the first time on 19 January 2026 and, during the morning session on 20 January, is currently trading near ₹3.15 lakh, while COMEX silver touched USD 94 per ounce. In just 19 days since the start of the year, silver prices have risen by over 31%, following an exceptional rally in 2025 that ranks among the strongest annual performances in recent decades. This surge has been accompanied by a sharp increase in volatility. Since the beginning of 2026, the average daily trading range of MCX Silver has expanded to 11,528, underscoring the intensity of price action and heightened market participation.

| YTD | 2025 | 2024 | 2023 | 2022 | 2021 |

| 31.64% | 170.20% | 17.20% | 7.23% | 10.78% | -8.00% |

Weaker Rupee:

A structurally weaker Indian Rupee has emerged as a major tailwind for domestic silver prices. Since the start of 2026, USD/INR has breached the 91 level, driven by persistent FII outflows and global trade uncertainty. For Indian investors, this effectively acts as a price multiplier. Even during periods of consolidation in COMEX silver, MCX prices tend to remain resilient. Domestic participants are benefiting from two simultaneous drivers: rising global silver prices and rupee depreciation, together amplifying returns.

Weaponization of Silver Trade:

China’s decision to introduce stricter export licensing requirements for silver from 1 January 2026 has added a strategic dimension to the ongoing rally. Under the revised framework, silver exports are subject to government approval and are limited to state-approved refiners, effectively increasing regulatory oversight on overseas shipments. This move tightens availability in the global market and reinforces concerns over supply security, particularly during a period of already tight balances.

Strategic Reclassification of Silver in the US:

In November 2025, silver was formally added to the United States Geological Survey’s 2025 List of Critical Minerals, recognizing its essential role in the economy and national security alongside other strategic materials.

Persistent Global Supply Deficit:

The global silver market is expected to remain in deficit for a fifth consecutive year. Global mine production stands at roughly 1 billion ounces annually, while analysts estimate a supply shortfall of around 110 to 120 million ounces this year, as mine output continues to lag rising industrial and investment demand.

ETFs Still in Catch-Up Mode: ETF investment demand in silver is recovering but remains below prior cycle peaks. Holdings in the iShares Silver Trust (SLV) have started to rise again after several years of sustained outflows, indicating a revival in investor interest from the 2024 lows. However, current outstanding shares and total holdings are still meaningfully below the highs recorded in 2021, suggesting that ETF participation has not yet returned to peak-cycle levels. This implies that while investment demand is improving alongside higher prices, silver ETFs are still in a catch-up phase rather than reflecting overcrowded positioning.

Gold Silver Ratio:

The gold–silver ratio (GSR) has broken decisively below the key 50 level. Over the past 25 years, the ratio has averaged close to 70. After briefly spiking to around 107 in April last year, reflecting extreme risk aversion and gold outperformance, the ratio entered a sustained multi-month decline and has since fallen to approximately 49.38, highlighting strong silver outperformance in the current cycle. For historical context, during silver’s peak near USD 49 per ounce in 2011, the gold–silver ratio had compressed further to around 30.

Rising AI and Energy Demand:

The rapid expansion of artificial intelligence is driving a surge in data-center construction, significantly increasing global electricity demand. To meet this requirement, renewable energy capacity, particularly solar power, is being scaled up aggressively. Silver plays a critical role in solar photovoltaic manufacturing due to its unmatched electrical conductivity. While silver is still relatively better compared to its counterparts, any demand destruction from higher prices is likely to occur gradually, as viable substitutes remain economically and technologically constrained. Over the medium to long term, AI-driven power demand is emerging as a structural tailwind, tightening the global silver supply-demand balance further.

Solar & Renewable Energy Stocks in India: Discover companies benefiting from India’s expanding solar capacity and clean energy push.

Artificial Intelligence (AI) Stocks in India: Explore Indian companies aligned with AI-led data center growth, automation, and next-generation technology adoption.

Global Silver Supply–Demand Balance and Top Producers

Global silver fundamentals continue to reflect a structurally tight market, with mine supply struggling to keep pace with steadily rising industrial and investment demand. Silver mine production remains highly concentrated, with a handful of countries accounting for a large share of global output. Mexico continues to dominate global silver production, followed by China and Peru, while output across several Latin American producers has shown only marginal growth.

| Country | 2023 | 2024 |

| Mexico | 181.9 | 185.7 |

| China | 111.6 | 110.1 |

| Peru | 108.9 | 108 |

| Bolivia | 43.2 | 47.8 |

| Chile | 52 | 43.2 |

| Source: Silver Institute World Silver Survey 2025 Unit: Million ounces | ||

Despite a gradual recovery in mine production, global silver supply continues to fall short of demand. According to the Silver Institute, the silver market has recorded sustained deficits since 2021, following a brief surplus in 2020 driven by pandemic-related demand destruction. Although the deficit is projected to narrow modestly, the persistence of negative net supply underscores the structural imbalance facing the silver market and explains ongoing physical tightness and elevated price volatility.

| Year | Supply | Total Demand | Net Supply Deficit | |

| Mine Production | Total Supply | |||

| 2020 | 783.8 | 974 | 929 | 45.1 |

| 2021 | 830.8 | 1,023.10 | 1,102.40 | -79.3 |

| 2022 | 839.4 | 1,034.60 | 1,284.20 | -249.6 |

| 2023 | 812.7 | 997.8 | 1,198.50 | -200.6 |

| 2024 | 819.7 | 1,015.10 | 1,164.10 | -148.9 |

| 2025F | 835 | 1,030.60 | 1,148.30 | -117.6 |

| Source: Silver Institute World Silver Survey 2025 Unit: Million ounces | ||||

Supply vulnerability is compounded by geopolitics. The US imports 67–80 percent of its silver needs, Mexico accounts for about 25 percent of global mine production, and China’s industrial demand remains dominant, supported by its roughly 50 percent share in global solar panel manufacturing.

Global mine production stands near 34,000 tonnes annually, while the solar industry alone consumes an estimated 10,000–14,000 tonnes each year. Electric vehicles use approximately 15 grams of silver in conventional systems and 25–50 grams in battery-driven platforms. Companies such as Tesla, Samsung, and Apple require assured access to physical silver inventories.

Risks & What Can Go Wrong

Substitution Risk

Substitution represents one of the key long-term risks to silver demand from the solar sector. At elevated price levels, silver has become an increasingly important cost component for photovoltaic manufacturers, prompting leading producers such as LONGi Green Energy and JinkoSolar to intensify research into silver-reduction techniques. Continued progress in metallization thrifting, which involves using less silver per cell, could gradually reduce the metal’s intensity of demand over time. That said, large-scale substitution away from silver remains technologically and commercially challenging at present, limiting its immediate impact on overall silver consumption in the solar industry.

Exchange-level interventions and Margin Tightening:

Exchange-level interventions, including higher margin requirements or tighter position limits, can quickly reduce leveraged participation. In past commodity cycles, such measures have triggered abrupt volatility spikes and short-term price corrections.

Sharp Profit Booking:

From a technical perspective, silver is overbought across most indicators. Prices have continued to push higher despite stretched momentum readings, driven primarily by structural supply deficit concerns. After such an exceptional run, it is reasonable to expect some speculative participants to reduce risk through profit booking, which could trigger periods of correction or consolidation in prices.

Gold – Months of relentless gains and the drop - Is It Time for Prices to Stabilize?

2 min Read Feb 2, 2026

Silver Price Outlook 2026: Will It Hit $100 or Pull Back to $90?

3 min Read Jan 22, 2026

Bullion Bear-hugged!

2 min Read Apr 13, 2013

Gold & Silver Prices Fall as Iran Conflict Sends Crude Oil Above $115

6 min Read Mar 9, 2026

MCX Adjusts Trading Hours: New Global Alignment Starts Today

6 min Read Mar 9, 2026

PG Electroplast Share Price Crashes 13% After LPG Supply Cut Amid Middle East Conflict

6 min Read Mar 9, 2026

Oil Prices Surge Past $100 as US-Israel War With Iran Disrupts Global Energy Supplies

6 min Read Mar 9, 2026

Oriana Power Share Hits Upper Circuit After ₹1,180 Cr Floating Solar Project Win

6 min Read Mar 9, 2026