Learn about ETF (Exchange Traded Fund) in Hindi with this Bazaar Basics video. Understand what ETFs are and how they work.

Verify your mobile number

Enter your mobile number & verify it with an OTP

Complete e-KYC

Enter your KYC details

Verify bank details

Add your bank details to link it with your Demat Account

e-Sign & Get Started

e-sign to open your account — now explore and invest in ETF

Keep the following documents & details handy when you open your account to make your journey smoother and faster

PAN card

Aadhaar card

Bank details

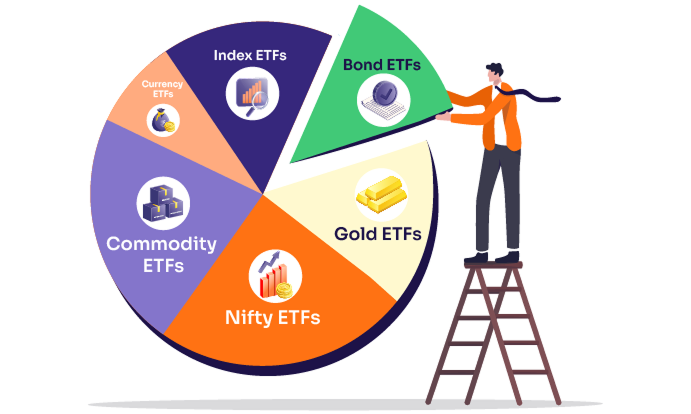

An ETF, or Exchange Traded Fund, is an investment fund that holds a collection of assets like stocks or bonds and trades on stock exchanges like individual stocks. ETFs offer investors a way to diversify their investments and gain exposure to a specific market index or asset class.

All about demat account, brokerage charges, account opening procedure and much more.

Unlike mutual funds which are priced once daily, ETFs trade throughout the day at market prices. ETFs also typically have lower expense ratios and offer more liquidity.

ETFs are as safe as the underlying assets they hold. They are subject to market risks and can fluctuate based on the performance of the index or assets they track.

Absolutely. ETFs are suitable for long-term wealth creation, especially for passive investors looking for low-cost, diversified exposure.

Yes, some ETFs distribute dividends if their underlying assets generate income. You can opt for dividend or growth options.