October 2025 recorded measurable improvement across India’s financial markets, supported by favourable macro data, strong institutional flows, and constructive global cues. Equity benchmarks — the BSE Sensex and NSE Nifty 50 — closed the month with absolute returns of ~4%, reflecting sustained buying interest across large-cap constituents and improving market breadth. Throughout the month, market participation widened as accumulation phases became more frequent, and daily institutional volumes stayed consistently positive, signaling deeper market confidence.

One of the most impactful developments was the sharp correction in inflation. Retail inflation declined to 0.25% in October, down from 1.44% in September, resulting in a 119-basis-point reduction month-on-month. This compression in price pressures enhanced valuation comfort and strengthened real return expectations. In the fixed-income segment, the 10-year G-sec yield eased from 6.57% to 6.53% (a 4-basis-point declinehelping stabilise the duration curve and reducing volatility in longer-maturity instruments, particularly for income-oriented portfolios. This combination of lower inflation and marginally softer yields created a supportive backdrop for both equity and debt risk-taking.

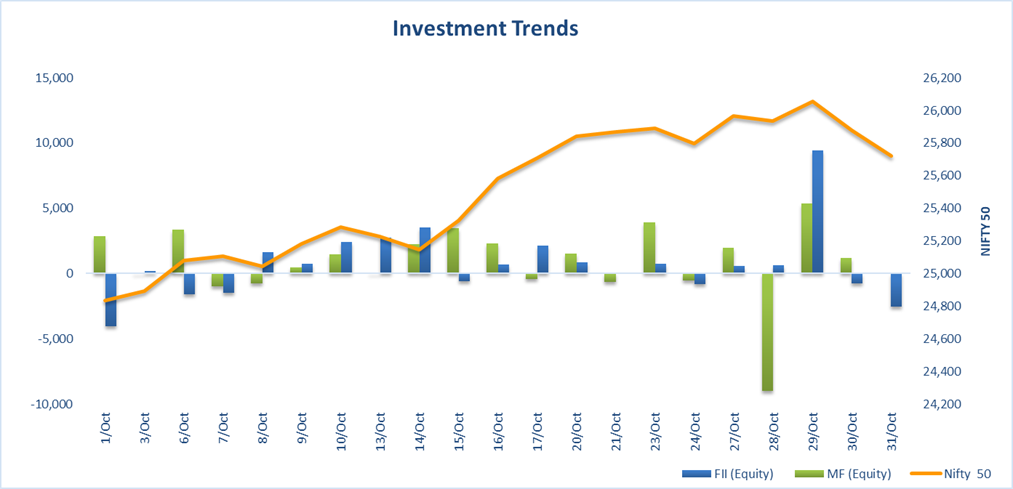

Investment trends across FIIs (Equity), Nifty 50 & MF (Equity):

Institutional flows further reinforced market strength. Foreign Institutional Investors (FIIs) recorded net equity inflows of ₹14,610 crore, while Domestic Institutional Investors (DIIs) reported a much larger ₹52,794 crore of net inflows. MF Equity saw an inflow of ₹17,778 crore.

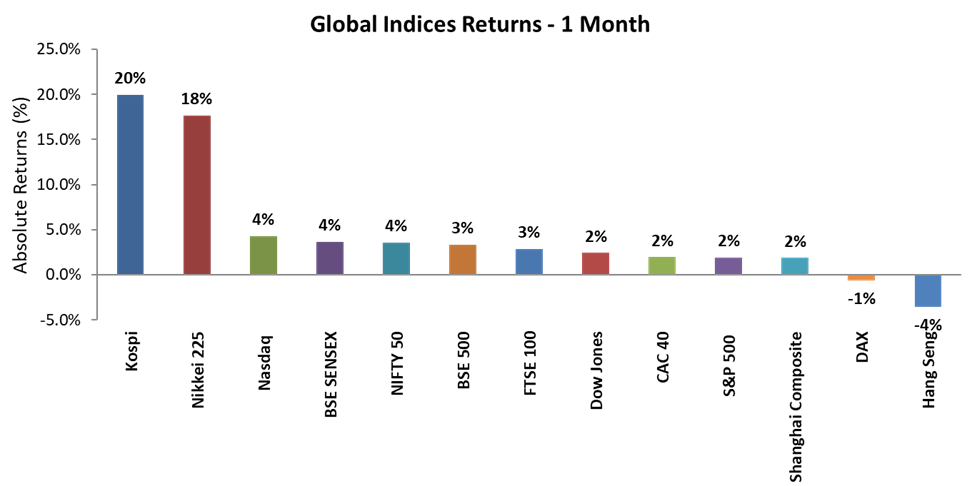

Global markets displayed notable divergence in performance. The KOSPI Index delivered a standout 20% return, followed by Nikkei 225 at 18%. U.S. markets were comparatively muted, with the Dow Jones returning 2% and the S&P 500 around 2%. Europe remained mixed: Germany’s DAX declined by 1%, while the FTSE 100 and CAC 40 posted modest gains of 2–3%. Meanwhile, the Hang Seng Index fell 4%, reflecting continuing macro and liquidity challenges in Hong Kong. The monthly Indices returns across regions highlighted the importance of selective global allocation and underscored India’s relative stability during the period.

India’s market landscape in October 2025 was shaped by:

Overall, October 2025 established a firm base for market momentum, supported by strengthening institutional participation, and favourable global alignment—setting a positive tone for the months ahead.

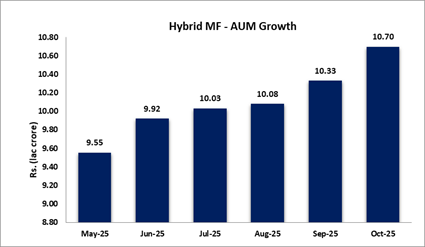

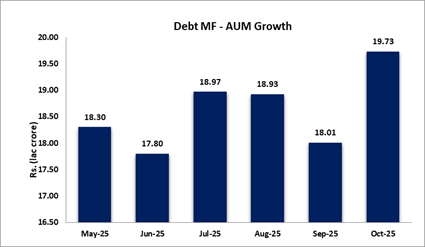

The mutual fund industry recorded broad-based quantitative improvement in October 2025, with month-on-month expansion visible across AUM, flows, and portfolio exposures.

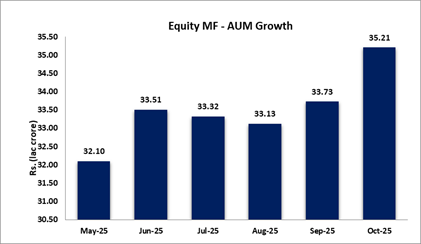

Equity AUM increased from ₹33.73 lakh crore in September 2025 to ₹35.21 lakh crore in October 2025, representing a +4.38% MoM growth. The Debt AUM trajectory strengthened materially, rising from ₹18.01 lakh crore to ₹19.73 lakh crore, a +9.57% MoM increase. Hybrid schemes reported a steady uptick as well, with AUM moving from ₹10.33 lakh crore to ₹10.70 lakh crore (+3.58% MoM). These three segments combined indicate a net AUM expansion driven by NAV appreciation and incremental net inflows.

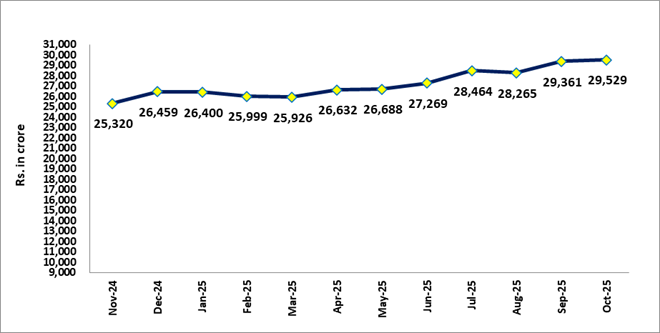

Systematic retail activity remained a key stabilising factor. Monthly SIP inflows increased from ₹28,265 crore in September to ₹29,529 crore in October, marking a ₹1,264 crore sequential increase and underscoring strengthening retail persistence.

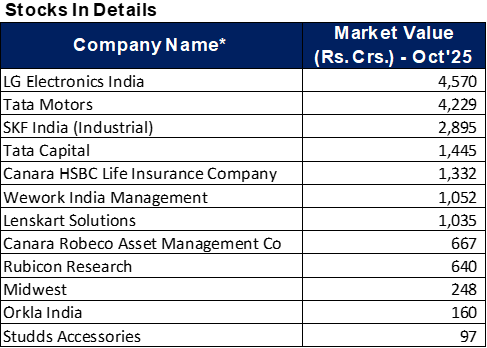

Fund manager activity reflected clear rotation signals:

The Stock-In list shows high-value allocations into LG Electronics India (₹4,570 crore), Tata Motors (₹4,229 crore), SKF India (₹2,895 crore) and Tata Capital (₹1,445 crore). These positions were not present at comparable scale the previous month, signalling a shift toward automobiles, industrials, and diversified financials. Smaller but meaningful entries included Canara HSBC Life (₹1,332 crore), Wework India (₹1,052 crore), Lenskart (₹1,035 crore) and Rubicon Research (₹640 crore).

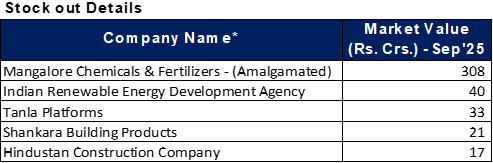

Conversely, the Stock-Out list from September shows exits from Mangalore Chemicals (₹308 crore), IREDA (₹40 crore), Tanla Platforms (₹33 crore), and Shankara Building Products (₹21 crore), indicating deallocation from low-liquidity or non-core exposures.

Market-cap allocation gives additional quantitative insight into fund positioning:

Overall, the industry exhibited numerically strong MoM expansion, supported by AUM growth across categories, upward SIP trajectory, multi-cap portfolio rotation, and solid net inflows—confirming a resilient performance for October 2025. The combination of expanding assets, consistent retail flows, and diversified positioning underscores the industry’s strengthened market stance heading into subsequent months.

Budget-to-Budget Winners: Top Performing Defence Stocks from 2025 to 2026

4 min Read Jan 23, 2026

How Top Rare Earth Metal Stocks Performed in FY26: Hindustan Copper, GMDC, MOIL, OMDC

4 min Read Jan 23, 2026

Hot Sectors to Watch Out: Top 3 Performing Sectors From Budget 2025 to Budget 2026

4 min Read Jan 23, 2026

What is Geothermal Energy? India’s First National Geothermal Energy Policy

4 min Read Jan 23, 2026

Gold Price Outlook 2026: $5,000 Rally or $4,600 Pullback Ahead?

4 min Read Jan 22, 2026