Royal Orchid Hotels Ltd (ROHL) operates and manages mid-to-upscale hotels under its own brands. The company currently has a portfolio of 9,583 rooms in 78 locations across India.

India’s hotel industry is undergoing a structural shift, driven by demand-supply gap, rising domestic travel, pro-growth policies, and accelerating demand for business-oriented stays. ROHL, an Indian hospitality brand, is well-positioned to capitalize on India’s evolving hospitality landscape, and the company is transforming into a technology-driven, asset-light hotel chain. ROHL’s ‘Vision 2030’ aims to grow from the current 115 hotels & 9,583 rooms (6,929 operational and 2,654 under development) to +345 hotels & +22,000 rooms by 2030. The target is to reach every district which has potential to attract tourists or business travelers. This growth will be achieved in an asset-light manner, primarily through franchisee properties, where ROHL will earn management fees by licensing its brand to local hotels. The initial capex required for these properties will be minimal, primarily for standardizing them to ‘Royal Orchid’ quality, with ongoing maintenance capex thereafter. This expansion will accelerate brand visibility across India, positioning ROHL among the largest hotel chains in the country.

The company has created a versatile brand portfolio with offerings for every traveler, ranging from upscale resorts to budget-friendly options. ROHL is implementing a structured brand portfolio:

| Net Revenue | EBITDA | Adj. Net Profit | EBITDA (%) | Adj Net (%) | EPS (₹) | BVPS (₹) | RoE (%) | RoIC (%) | P/E (X) | EV/EBITDA (X) | |

| FY24 | 293.6 | 76.1 | 48.5 | 25.9 | 16.5 | 17.7 | 75.9 | 25.4 | 27.2 | 29.1 | 18.8 |

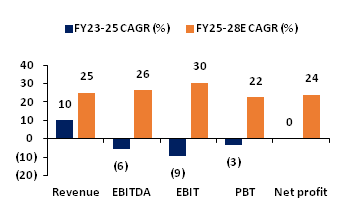

The company reported FY25 net revenue of INR 319 cr and targets INR 450-480 cr in FY26, INR 550-600 cr in FY27 and ~INR 1300 cr by FY30. ARR is expected to grow 5-8% with ~75% occupancy. The current gross debt is INR 100 cr, and ROHL aims for an asset-light model, using FCF selectively for expansion and debt repayment, primarily relying on internal accruals for growth. Over FY25-28E, ROHL’s revenue, EBITDA & net earnings are projected to grow at a CAGR of 24.8%, 26.2% & 23.8%, respectively, reaching INR 621 cr, INR 147 cr & INR 90 cr. Our estimates are lower than management targets as we have taken a conservative approach in our forecast. EBITDA margins are expected to expand by 80bps to 23.7%, while net margins could decline by 34bps to 14.4% due to an increase in lease expenses. Strong operating performance is expected to improve return ratios - RoE & RoIC could improve by 110bps to 21.6% and 660bps to 25.7% by FY28E

Disclaimer: Ventura Securities Limited (VSL) is a SEBI-registered intermediary offering broking, depository, and portfolio management services, with no significant disciplinary actions in the past five years. The report is for informational purposes only and does not constitute investment advice, an offer, or solicitation to buy or sell any securities. Past performance, projections, and forecasts are not guarantees of future results, and investors should independently evaluate risks and consult financial advisors before investing. VSL, its associates, and research analysts disclaim any liability for losses arising from the use of this report, which is strictly confidential and intended solely for the recipient

Budget-to-Budget Winners: Top Performing Defence Stocks from 2025 to 2026

3 min Read Jan 23, 2026

How Top Rare Earth Metal Stocks Performed in FY26: Hindustan Copper, GMDC, MOIL, OMDC

3 min Read Jan 23, 2026

Hot Sectors to Watch Out: Top 3 Performing Sectors From Budget 2025 to Budget 2026

3 min Read Jan 23, 2026

What is Geothermal Energy? India’s First National Geothermal Energy Policy

3 min Read Jan 23, 2026

Gold Price Outlook 2026: $5,000 Rally or $4,600 Pullback Ahead?

3 min Read Jan 22, 2026