Copper prices are expected to surge sharply by 2026, driven by global demand from electric vehicles, renewable energy infrastructure, and grid modernization is colliding with mining operations that can’t expand fast enough to keep up.

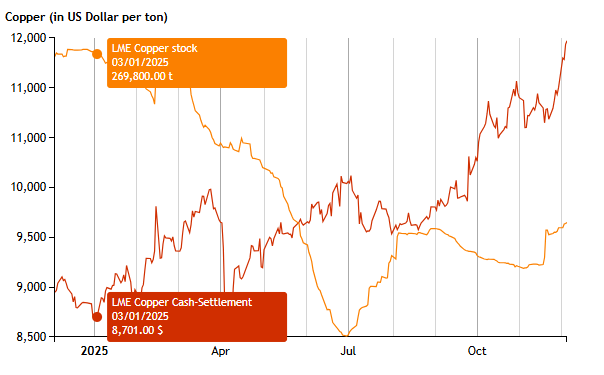

Copper futures in the United States climbed to about $5.47 lbs, the highest level in four months, driven by tight supply conditions and strong premiums. The move followed record high $11500 per tonne on the London Metal Exchange Since late August, LME copper prices have gained roughly 26% in 2025 due to persistent shortages. Meanwhile, traders have been sending more shipments to the U.S. to take advantage of high Comex prices, especially amid uncertainty surrounding potential future tariffs under President Donald Trump.

Liquidity remains tight in physical markets

Copper prices were boosted by supply pressures such as reduced production in Chile, planned output cuts by Chinese smelters, and a weaker U.S. dollar. The dollar declined as traders positioned themselves ahead of a possible Federal Reserve rate cut next week.The catastrophic events at Freeport-McMoRan's Grasberg mine in September 2025 have caused a major supply shock, tightening the global copper market and leading to significant price surges. Production is not expected to return to pre-accident levels until at least 2027.

Copper declared a critical mineral in the U.S.

The U.S. Geological Survey recently added copper to its critical minerals list. This shift could drive strategic stockpiling, policy changes, and stronger industrial usage, all supportive of a tighter global supply outlook.

YEAR 2025 LME COPPER PRICE / LME INVENTORY

Rupee / USD-INR impact on MCX Copper price

Rupee weakness boosting copper prices domestically. The rupee has weakened from around 85.6 per dollar in January to almost 90, with most of the decline occurring after mid October. Since copper is an import dependent commodity, this currency depreciation adds additional upward pressure to domestic prices.

Here’s how copper pricing evolved over the past five years in Rupee:

| Year | MCX Price per KG | Net Percentage Change | Market Context |

| 2025 | RS 1076.55 | 35.72% | Sustained structural shortage |

| 2024 | RS 793.2 | 8.58% | Supply deficit becomes apparent |

| 2023 | RS 730.55 | 1.65% | Energy transition acceleration |

| 2022 | RS 718.7 | -4.03% | Inflation concerns, China slowdown |

| 2021 | RS 748.9 | 25.93% | Post-pandemic recovery surge |

| 2020 | RS 594.7 | - |

Key figures on India's copper demand:

FY 2024-25: The demand was around 1.9 million tonnes (1,878 kilotonnes), a 9.3% increase

from the previous fiscal year.

FY 2023-24: The demand reached 1.7 million tonnes (1,700 kilotonnes), showing a 13%

year-on-year growth.

India’s non-ferrous metal sector witnessed significant growth in FY25, with refined copper production recording notable increases. Refined copper production rose by 12..6 per cent, climbing from 5.09 lakh tonnes (LT) in FY24 to 5.73 LT in FY25, according to government data.

India's copper imports rose 4% to 1.2 million metric tons in the fiscal year to March 2025. Demand is expected to climb to 3-3.3 million tons by 2030 and 8.9-9.8 million tons by 2047, the government has said.

With demand rising 9.3% in FY25 while domestic production covers only a fraction of that, the demand–supply gap is widening.

This imbalance has led India to rely heavily on imports of refined copper, concentrates, and scrap. Source: International Copper Association India

Demand trajectory shows strong momentum in coming years as infrastructure projects, renewable-energy roll-out and electrification continue. Industry forecasts see demand continuing to rise substantially.

Goldman Sachs projects sustained demand growth of 2-3% annually through the end of the decade. Morgan Stanley’s metals team forecasts supply deficits continuing until at least 2028. The International Copper Study Group expects global refined copper consumption to exceed production by 200,000-300,000 tons in 2025.

The consensus view holds that copper entered a sustained high-price environment driven by structural factors rather than speculation. Barring major technological disruption or dramatic demand destruction, elevated pricing appears likely to persist.

Most commodity analysts expect copper to trade between $4.80lbs and $6.00lbs through 2026. This range reflects uncertainty about China’s economic growth and potential delays in renewable-energy projects, although few analysts expect prices to fall below $4.50 per pound. Meanwhile, on LME predictions suggest that prices could reach around $12,000 per tonne in 2026, and on the MCX, prices may climb to ₹1,200 per kg, following our earlier blog post in which the ₹1,080 per kg target was successfully achieved

Important Budget 2026 Terminologies You Must Know Before February 1st, 2026

3 min Read Jan 20, 2026

Union Budget 2026: Halwa Ceremony; Here’s Its Significance

3 min Read Jan 20, 2026

Top 5 Stocks FIIs Bought in Dec 2025 Quarter: Bank of India and HBL Engineering in Focus

3 min Read Jan 19, 2026

RBI Changes CIBIL Reporting From April 1, 2026: Full Details and Impact on Borrowers

3 min Read Jan 19, 2026

NRI Tax on Gold ETF Gains in India: Updated Rules, Dates & Practical Guidance

3 min Read Jan 16, 2026