Stock baskets thoughtfully curated by experts for steady wealth creation.

Let’s Get Started

Backed by expertise

Backed by expertise Thematic investing

Thematic investing Diversified approach

Diversified approach Timely rebalance

Timely rebalanceFor beginners or investors just starting out, Wealth Builder Portfolios provide a guided and simple way to invest in stocks and ETFs. They combine expert guidance with diversification, helping you build your wealth steadily and confidently.

Ideal for those looking to invest in a specific theme or idea through curated stock baskets aligned with their financial goals.

Perfect for market participants who value professional research and stock analysis but still want control to customise, rebalance, or exit their stock baskets.

For investors who want exposure to stocks in India but don’t have time for detailed research, Wealth Builder Portfolios provide ready-made, research-backed stock baskets. This approach is especially helpful for HNIs and professionals, allowing them to invest confidently while relying on expert analysis.

For investors who want to build wealth steadily, curated stock baskets simplify investing in stocks while keeping goals aligned with growth.

Our research team does the hard work of handpicking stocks using in-depth market analysis to bring you ready-made stock baskets built for your financial goals.

Each basket is tailored to your investment strategy and diversified across stocks to manage risk while building wealth.

Invest across trending themes and ideas approved by analysts so you can invest without second-guessing.

Execute orders seamlessly within a single click, letting you save time and execute without complexity.

Your investments stay liquid with no lock-ins, so you’re always in control.

Full control and visibility of holdings, enabling timely adjustments to suit market conditions.

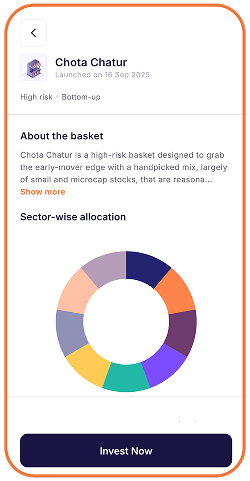

Chota Chatur

Chota Chatur Contra Pulta

Contra Pulta Healthy Thali

Healthy Thali Nirantar Aaye

Nirantar Aaye Urjaa Express

Urjaa ExpressVentura’s Wealth Builder Portfolios offer a guided, expert-curated approach. Simply browse, select, and invest in diversified stock baskets, combining top picks and stock analysis to help you grow wealth confidently.

Explore Wealth Builder Portfolios in Spotlight

Select a stock basket, check its stock analysis, and enter your investment amount.

Review the stocks and place your order instantly with seamless execution.

A stock basket is a group of stocks grouped together under a single theme or strategy.

Investors can put money into a basket that reflects a bigger idea, like sectoral growth, market trends, or investment styles, instead of buying individual stocks and maintaining a watch on them separately. This means that curated stock baskets are an easy and efficient way to invest that cuts down on the work of researching and picking from a stock list.

Wealth Builder Portfolios are curated stock baskets that make it easier for investors to find curated mini-investment portfolios. Stock baskets are intended to help investors save time and focus on their strategy. For instance, a basket could have stocks from the banking sector or companies that are likely to grow over the long term. Others may be designed for short-term analysis.

Baskets let investors follow trends without having to keep up with every company or constantly rebalance their portfolios by putting stocks into a theme.

Wealth Builder Portfolios go even further by giving you baskets based on in-depth market analysis and stock analysis. Another beneficial aspect of stock baskets is that they are simple to get started. An investor can buy an entire basket in one step instead of making multiple trades, streamlining order execution. This makes it easier to diversify. In short, stock baskets are a better and more organised way to invest.

Wealth Builder Portfolios help make this idea real by giving you prearranged, ready-made options and top picks to explore.

A curated stock basket is a ready-made investment portfolio of expert-selected stocks, grouped around a theme, strategy, or financial goals. Instead of picking from a long stocks list, you get a simplified, research-backed collection of top picks. It saves you time on stock analysis while giving you instant diversification and seamless order execution in just one click.

Wealth Builder Portfolios are curated and managed by Ventura’s expert research team. They use detailed stock analysis and market analysis to shortlist top picks and build curated stock baskets. The aim is to align each investment portfolio with different financial goals.

Yes, Wealth Builder Portfolios are designed to give you access to a mix of stocks and ETFs in a single curated stock basket. This allows you to diversify your investment portfolio while aligning with your financial goals, whether they are short-term or long-term. The combination of both ensures a smarter balance between growth and stability.

Rebalancing is the process of updating your curated stock baskets to keep them aligned with the theme and your financial goals. Based on regular market analysis, certain stocks may be suggested for addition, removal, or weight adjustment. You’ll receive alerts for these changes, and rebalancing happens only when you review and approve them, ensuring your investments stay relevant without having to track every stock yourself.

Portfolios are reviewed on a regular basis by our research team. Rebalancing takes place in line with stock events or market movements. This ensures that the curated stock baskets continue to follow their investment strategy and remain aligned with financial goals.

Yes. Whenever a Wealth Builder Portfolio you’ve invested in is rebalanced, you’ll get an alert via WhatsApp or push notification. This way, you stay informed and can approve any changes to your curated stock basket, keeping your investments aligned with your financial goals.

Yes, you need to have a demat and trading account with Ventura to invest in Wealth Builder Portfolios. This is because your investments are directly placed in the stocks list within each curated basket, and the shares are held in your Ventura demat account just like any other equity investment.

Investing is simple and quick. Just follow these steps:

Browse: Open Spotlight and explore Smart Investment Baskets to find the Wealth Builder Portfolio that suits your financial goals.

Select: Choose your basket, click Invest Now, and enter your preferred amount.

Invest: Complete the order, and your curated stock basket is added to your portfolio in just a few taps.

Yes, each Wealth Builder Portfolio has a minimum investment amount, typically based on the combined price of the underlying stocks. This amount may vary across curated stock baskets.

Yes, Wealth Builder Portfolios are curated stock baskets designed to make investing easier for both beginners and experienced investors. Our research team manages the stock analysis and portfolio selection, so you can stay focused on your financial goals.

Wealth Builder Portfolios are curated stock baskets designed by experts to simplify investing. They combine top stock picks, diversification, and professional analysis, helping you invest confidently and focus on your financial goals.