Discover how to set up a Systematic Investment Plan (SIP) using the Ventura app.

Verify your mobile number

Enter your mobile number & verify it with an OTP

Complete e-KYC

Enter your KYC details

Verify bank details

Add your bank details to link it with your Demat Account

e-Sign your account

Your account will be under the on-boarding process

Keep the following documents & details handy when you open your account to make your journey smoother and faster

PAN card

Aadhaar card

Bank details

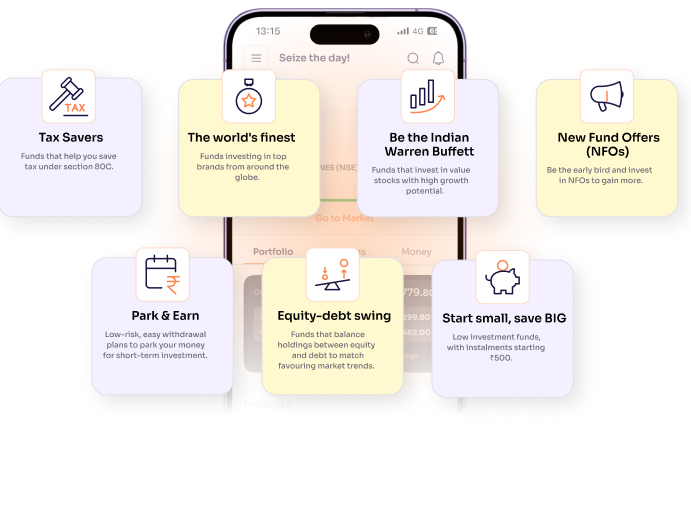

A Systematic Investment Plan (SIP) is a method of investing in mutual funds where you contribute a fixed amount at regular intervals such as monthly or quarterly, instead of investing a large sum at once. This strategy helps in building wealth over time while reducing the impact of market volatility. Think of SIP like a recurring deposit, where a fixed sum is deducted from your bank account automatically and invested in a mutual fund of your choice. The beauty of SIP lies in its simplicity: you start with as little as ₹100 per month, making it accessible to everyone, regardless of income level. The mantra of SIP is simple: Start early, invest regularly, and stay invested for the long term.

All about demat account, brokerage charges, account opening procedure and much more.

Yes, but only through manual SIPs. Most automated SIPs require a fixed amount every month. If you want flexibility, you can manually invest varying amounts each month though it won’t be a formal SIP, the cost-averaging benefit still applies.

While it’s emotionally tempting, pausing SIPs during volatility can defeat the purpose of rupee cost averaging. Volatile periods are when SIPs shine the most, as you buy more units at lower prices.

Not necessarily. SIPs are just a method of investment, not a product type. You can set up SIPs in debt funds, hybrid funds, or even gold mutual funds it depends on your financial goal.

While most people pick a fixed date (e.g., 5th or 15th), it doesn’t matter much over the long term. However, some investors stagger multiple SIPs across different dates in the month to spread market entry risk.

Absolutely and that’s a smart move. Many investors now create “goal-based SIPs”, where each SIP is tied to a target (like a vacation, child’s education, or house down payment) and has its own fund and timeline.

Many fund houses offer SIP top-up or step-up SIP options. You can automatically increase your SIP by a fixed percentage or amount every year aligning it with salary hikes and inflation.

If a fund is merged or wound up, your SIP stops, and your units are either transferred to a new scheme (if merged) or redeemed (if shut down), with the amount credited back to your bank.

Yes but with caution. For goals under 3 years, use SIPs in low-risk debt or liquid funds, not equity. SIP is just the tool; the fund choice should match your time horizon.

No. SIP returns are percentage-based and do not change with the amount. Whether you invest ₹500 or ₹50,000 monthly, your annualized return (XIRR) is calculated the same way.

Yes, but understand the trade off. During bull runs, SIPs may buy fewer units (as NAVs rise), yet they maintain discipline. If markets are overheated, lump sum investments carry higher timing risk, while SIPs

average out over time.